- Home

- >

- FX Daily Forecasts

- >

- USDX remains in the boundaries of the uptrend

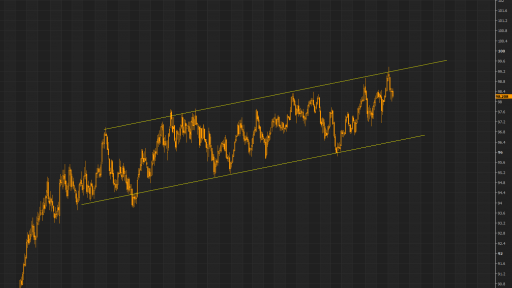

USDX remains in the boundaries of the uptrend

The dollar index has remained suppressed in recent days as sentiment risk improves. Positive prerequisites for trade negotiations and prospects for lower interest rates keep the dollar lower, and contrary to expectations of the dollar index above 100, it is still far below this level, but within the upward movement. In the event of an additional loss of dollar strength, we will expect it to fall first to the area from the previous bottom at 97.2 - 07.6 for the first test. If the momentum goes down, we will expect movement to the lower diagonal support and test in the zone at 96.7.

In terms of positioning, debt is at its lowest level since June 2018 and just above average, signaling a minimum dollar strength from a technical point of view. Investors' withdrawal from USD is completely normal and expected against the background of the upcoming Fed interest rate decision, which is expected to be 25 points at this stage.

Graphs: Thomson Reuters

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.