- Home

- >

- Stocks Daily Forecasts

- >

- Value or Growth in 2020 and is it worth the passive investment?

Value or Growth in 2020 and is it worth the passive investment?

The end of the year is approaching and US stocks are set to close at All Time High and prove that the longest bullish market in history is still intact.

Up-trend that starts on March 9, 2009. it seems to remain steadfast despite the slight turmoil on the way to here.

In part because of the Fed's highly flexible monetary policy, which has brought yields down to historic lows, the SP500 has seen the highest yields in the nearly 10 years since the uptrend started. Let's look at:

But while this is the longest bulls marathon, it is certainly not the strongest. The best performance of the last eight bullish markets was in the 90s, when the SP500 earned over 300% yield.

Who led to the current growth?

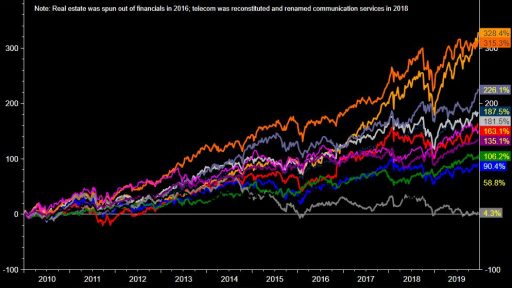

The profits of the SP500 have been fully fueled by the technology, energy and consumer sectors, which have managed to exceed 300% profitability over the past 10 years.

Growth or Value investments dominated the last period? The chart below shows that investors are becoming more likely to take higher risks by channeling more cash flow to Growth companies.

And when it comes to risk ... here are the top performers:

What should we do as thinking investors, given the fact that we are in a record-breaking economic cycle?

Let's go back to Value and Growth companies! What are they?

Growth companies are considered companies that have the potential to outperform the entire market in time because of their future potential, while Value companies are characterized as stocks that are currently trading below their intrinsic value but with a proven business model and less likely to grow big and fast.

Which category between Value and Growth companies is better depends on where we are in the economic cycle.

If we are in the beginning of a new economic cycle, after the recession it is good to focus on Growth companies, since the prospect of improving the economic situation in the coming years is good. Also consider that after the recession, Growth companies will have already made a very large price adjustment.

On the other hand, if we are at the end of an economic cycle, as it is said at the moment, it is good to focus on Value - companies that have a solid business model and have proven themselves over time.

The long bullish trend, as well as the extremely long economic cycle, have reached almost a decade, which will make investors consider Value companies more attractive than risky investments

Източник: Reuters

Графики: Reuters

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.