- Home

- >

- Daily Accents

- >

- Varchev Finance: Trading Day in One Post – 12.09.2018

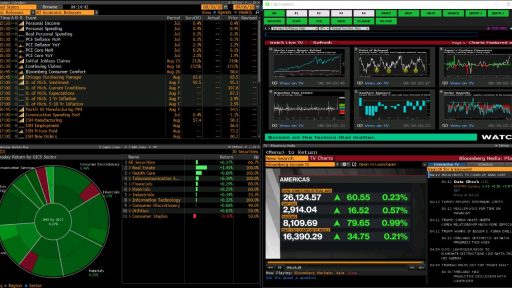

Varchev Finance: Trading Day in One Post - 12.09.2018

Asian Stock Market - Asian markets could not absorb the positive moods that arose during the US session because China has asked for a World Trade Organization (WTO) permission to impose annual sanctions of $7b against the United States. Nikkei 225 fell 0.43% and Kospi traded 0.40%. Expectedly, China's markets are the most declining. Hang Seng traded at -0.57% and Shanghai composite with -0.39%.

FX Market - The transition of Asian stock markets to the negative territory and the bear market has led to the sale of high-risk currencies, such as AUD, NZD, while JPY has taken advantage of the situation. I expect the positive sentiment for JPY to be maintained, with the launch of the European interbank market leading to purchases of Safe Haven currency. I expect CAD to maintain its upward momentum even today, against the backdrop of advances in the US-Canada negotiations with regard to NAFTA. USD will most likely remain under pressure mainly due to the Risk Off situation of the European and US Stock Market.

Commodity Market - Until Hurricane Florence passes, oil will continue to receive support. The next days will be key to black gold, and the more damage the worst the hurricane ever has in the history of the US, the more expensive oil we can expect. As for gold, there is no reaction yet, despite the upcoming threats of bad weather and China's intentions to impose sanctions against the United States. The crisis in the developing markets also does not affect the precious metal. I expect the pressure on Gold to be maintained today, especially for the expected positive moods during the European session.

European stock market - European markets are preparing to start trading with slight declines, which as time goes on I expect them to be fully covered and European markets to be traded on green territory. The main reason for this will be the positive moods of Wall Street and the progress of the US-Canada talks and the EU and the United States. Here are the indicative values: DAX30 with 9 points lower at the price of € 11986; CAC40 with 9 points lower at the price of € 5287; UKX with 7 points lower at 7267 pounds.

The US stock market - Apple and Exxon Mobil managed to raise the Dow Jones by 114 points, and the index gained additional support from Nike, which jumped 0.65% after analysts from Canaccord Genuity changed its recommendation for the company's securities from a "neutral" "Buy". The S & P500 jumped 0.37% to 2887.89 points, with the focus here mainly on the technology and energy sectors. Nasdaq Composite rose 0.61 percent to 7972.47 points, with some of the largest technology companies reporting a rise in stock prices.

Economic calendar for the European and US trade session - 12.09.2018

12:00 Europe - Industrial Production

14:20 US - OPEC Monthly Report

15:30 USA - PPI

17:30 US - Crude oil inventories

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.