- Home

- >

- Fundamental Analysis

- >

- Waiting only occasion to start new EUR-sales

Waiting only occasion to start new EUR-sales

After Reuters report that ECB actually considering to lower deposit rate at its next meeting (although it is negative) is activated the sale of EUR.

Initial estimates were lower bank deposit rate by 10 basis points to -0.30 percent.

Today, however, discuss rumors of a new version - with an even more aggressive reduction of "criminal" interest on bank deposits. Until recently, the negative actual interest rates were mostly theoretical in some macro econometric models. Today, however, central banks are gaining confidence after the similar interest of the Swiss and the Danish central bank function at a level of -0.75%, indicating that it is not impossible and such positioning.

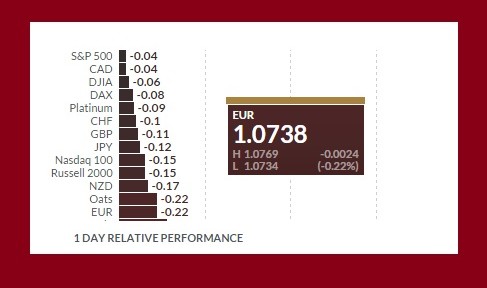

Speculations about a decrease in the bank-deposit interest of the ECB meeting on 3 December triggered a sharp decline in the European currency, but only a new momentum and a break below 1.0700 dollar may decline to deepen its next probable support around 1.0660 and 1.0520. At this stage, remain for a moment in the shadow options for the ECB-QE program, which continues to be a controversial effect, despite categorical assessments given periodically by Draghi. New statements on this topic will also cause a market reaction and even less EUR.

This trend will continue to deepen, then the likelihood of increases in US interest rates by the Fed is currently set at 15/17 and divergent monetary policies of major central banks continue to show completely opposite directions.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.