- Home

- >

- FX Daily Forecasts

- >

- Wall Street big player for GBP/USD by the end of the year

Wall Street big player for GBP/USD by the end of the year

Undoubtedly, the forex market is the major investment banks, and many traders are ready to know what their predictions are about the development of a currency pair. In this article, we will look at forex forex and what do they think about GBP/USD by the end of 2018?

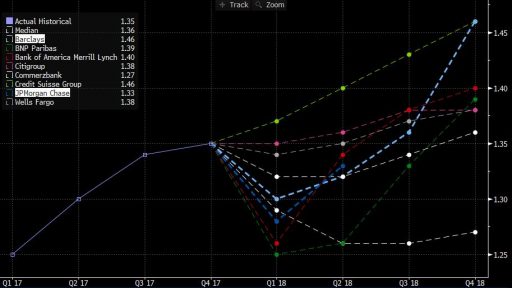

The average of all forecasts for the GBP/USD is that the pair is traded down in the first nine months of the year and then rises to 1.36. Credit Suisse is most optimistic about the GBP rise and predicts the currency will pick up steady growth over the four quarters of the year and end at levels around 1.4600. Barclays also think the pair will end in 2018 at levels around 1.4600, but they expect a decline to 1.30 by the end of March. Bank Of America Merrill Lynch are more conservative and expect a sharp decline in the first three months to 1.26, then rise to 1.40 at the end of the year. Similar to BAML, BNP Paribas also expected a GBP/USD decline, but to 1.25, then consolidation between 1.26 and 1.25 and strong growth in the second half to 1.39 at the end of the year. Citigroup and Wells Fargo forecast a slight increase in price to 1.38 and weak volatility throughout the year. So far, everyone predicts an increase in GBP against the USD, but Commerzbank is different from the crowd, and their analysts believe the pound will lose support, and at the end of the year it will trade at levels around 1.27. Unlike the others, JP Morgan does not commit to a forecast by the end of the year, but they believe that in the first half the GBP will be trading at levels around 1.33.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.