- Home

- >

- FX Daily Forecasts

- >

- Wall Street for GBP: Go Sell in short term and Buy in long term

Wall Street for GBP: Go Sell in short term and Buy in long term

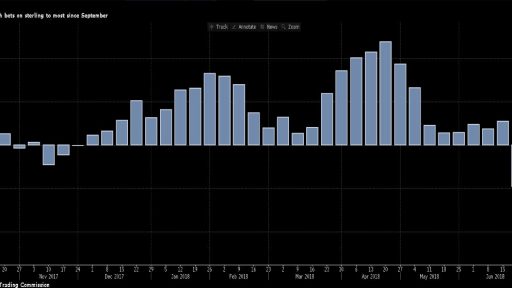

More and more hedge funds prefer to be GBP Short in the medium term. According to CFTC, large investors increase their short exposure by over 33% to -28,781 contracts. This is the highest level reached by Short Sellers in the last 9 months. For the last time, we watched such short-stacked volume in September last year, after which the GBP recorded a close to 5% adjustment against the USD and most major currencies. Adding to the crisis in the British government that occurred yesterday, the prospects for the cable do not look good.

Let's see what the Wall Street big banks expect from the GBP

Despite the temporary difficulties faced by the British political scene, Wall Street leaders are of the opinion that after one year the GBP/USD will be far higher than today. The average forecast of all investment banks is $1.3800 per pound, with only Morgan Stanley believing that the pair may be down by more than the current levels to around 1.3000 at the end of the year. Among the other FX market leaders, positive expectations are predominant, and you can follow them in detail on the chart above.

Source: Bloomberg Pro Terminal

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.