- Home

- >

- Daily Accents

- >

- Wall Street in second stage sell off

Wall Street in second stage sell off

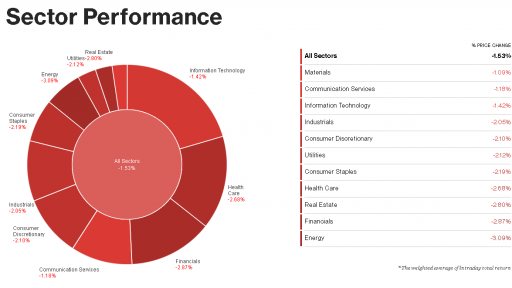

A new wave of sell-offs covered Wall Street, this time being triggered by a drop in oil that dragged the energy sector to new bottoms. At the same time, the lower US CPI and Trump's comments are driving investors to rethink, the Fed's attitude to monetary policy and the likelihood of seeing a new hike by the end of the year. This has a severe negative impact on the financial sector, which is nearly 3% lower.

Increasing yields on US government bonds continue to keep investors on the lookout for fears that rising borrowing costs may slow down the economy. Concerns about the future of the US monetary policy pose additional concerns as the Fed has raised interest rates three times this year and is expected to raise them a great deal once again by the end of the year.

According to Donald Trump, the central bank of the United States, the Fed, are "crazy" to continue tightening monetary policy.

"They make a big mistake," said Trump, commenting on the biggest fall (yesterday) that stock exchanges have suffered in the past 7 months.

"I think they are crazy."

For some time now, Trump has expressed disagreement that the Fed is continuing to raise its short-term interest rates with its plan.

But his comments on Wednesday were the first to openly accuse the Fed that the markets have suffered these losses.

"Actually, it's the correction we've been waiting for a long time, but I really do not agree with what they're doing."

International Monetary Fund Chief Executive Christine Lagarde disproved Trump's allegations, saying she would "not connect" Fed chair Jerome Powell with madness.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.