- Home

- >

- Daily Accents

- >

- Wall Street quietly buried its dreams for Bitcoin

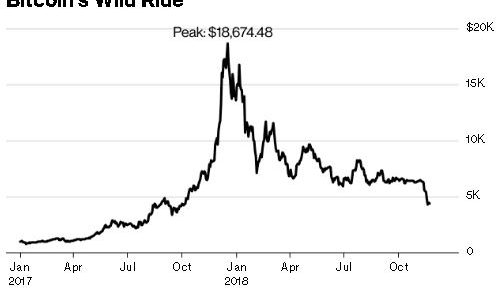

Wall Street quietly buried its dreams for Bitcoin

Goldman Sachs, Morgan Stanley and many others had this dream. But it did not come true.

Limbo - there is Wall Street when it comes to crypto currencies.

With claims from its very beginning to pursue high profits at one of the dark corners of the financial sphere, proven companies this year have slowed down their already aspiring aspirations to do some business of the entire Bitcoin mania. Some of the companies have yet to surrender and continue to develop crypto infrastructure, but most of them have already begun to dump the collapse of the value of the original crypto.

Goldman, who intended to be in the forefront of the digital asset revolution, was in a skeptical mood. For them, crypto have become the halo of intraday traders and anarchists. The progress of the bank to enter this sphere was so slow that it was barely noticeable, according to critics familiar with the business. Many of the industry have already said it was quintessential to expect last year's ecstasy to be transferred to Wall Street to repeat itself in 2018.

The market has had unrealistic expectations that Goldman or some of the industry will suddenly be able to start a successful business with Bitcoin Trading. The launch of the Bitcoin ETF in the US was "the top of the ice cream" and is considered to be the biggest fiction to trigger extra, hyperintersection to the Crypto markets.

Even after the bubble bursting, which caused a $ 700 billion market capitalization, the believers and the Crypto evangelicals continue according to their "script".

Morgan Stanley has the technical ability to provide Bitcoin futures since September, but no contract has so far been traded, according to an acquaintance. According to the acquaintance, these futures will immediately come into use, as long as an institutional customer is looking for a search. There is currently no such thing.

Citigroup also did not deal with any of its Crypto products that are in line with regulations. Citigroup offers the ability to trade Bitcoin certificates through an intermediary without actually owning the basic coin.

In London, Barclays Plc. even they have gone back to scratch to review a possible crypto product. For the time being, there is no specific plan for implementing a separate Crypto Trading Desk.

After the stunning sale of digital assets this year, after reaching its peak of $ 20,000 in 2017, Bitcoin is now traded slightly below $ 4,000. This is what the crypto professionals are relying on as a sign that institutional investors are ready to enter.

Intercontinental Exchange, which owns the New York Stock Exchange, said in August that they have created an infrastructure that allows institutions and consumers to buy, sell, store, and spend digital assets. Meanwhile, Fidelity Investments said in October that they were preparing a new business structure to manage digital assets for hedge funds, households and trading firms. Another encouraging news for the crypto bulls was the Yale University investment in the Cripple Fund.

Losing $ 700 billion obviously can not deter Crypto enthusiasm. Believers blindly in digital assets continue to recite their promising scenario.

According to Eugene Ng, a former trader at Deustche Bank AG, the founder of Circut Capital, the bear market will allow many of the institutions to create the necessary foundations without hurrying to make a scarce infrastructure to test long enough to implement it.

Източник: Bloomberg Finance L.P.

Графики: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.