- Home

- >

- Great Traders

- >

- Warren Buffett’s 9 best pieces of advice on success

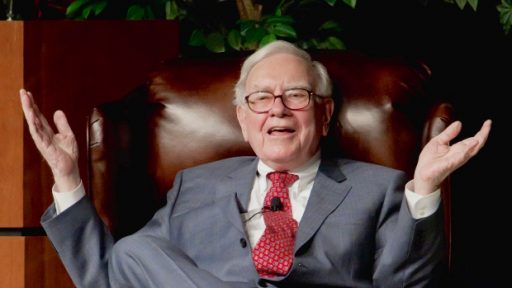

Warren Buffett's 9 best pieces of advice on success

When it comes to getting rich, Warren Buffett is in a class all his own.

The 87-year-old founder and CEO of Berkshire Hathaway is worth $87 billion. He first became a millionaire when he was 32.

Buffett's skill and success with the stock market has reaped major benefits and earned him a nickname: "The Oracle of Omaha."

Unsurprisingly, many people want to be as rich as Buffett. In fact, most people would probably settle for a fraction of his net worth. Thankfully he's doled out some helpful advice over the years so others can follow his strategies.

Buffett and Berkshire Hathaway notably invest in stocks over bonds and prefer long-term strategies to constant day trading, but it is more than what and how Buffett invests that has made him successful.

Keep reading for nine of Buffett's best pieces of advice on getting rich.

Play the long game.

To make money, an investor shouldn't buy a stock with the sole intention of selling, Buffett believes. You're in it for the long game.

"Our favorite holding period is forever," Buffett first said in the 1988 shareholders' letter.

Buffett only buys stocks of companies he understands and likes, and thinks selling should be done when you need the money and not when you believe it is a strategic jumping off point.

Always learn new things and be humble.

Years ago, Buffett gave an entrepreneur some advice over drinks. He told her to learn something every day, confront opportunities, and always be humble. Though it's not outright investing advice, it's a strategy anyone in business would be smart to mimic.

Buffett still goes through the newspaper every morning and reads books throughout the day.

"That's how knowledge works. It builds up, like compound interest," he says.

Invest your own money.

Pointing to the four times that the value of Berkshire Hathaway plummeted, Buffett explained the trouble of using loans to invest in stocks in his 2018 annual letter. A drop in the value of a stock may cause an investor unneeded worry and lead to poor decisions if the money isn't entirely theirs to begin with, he said.

On the flip side, Buffett said investors with extra cash and no debt have great opportunities when the market drops because they don't have to worry about paying someone back and can be aggressive with their investments.

Build relationships and treat people well.

When Buffett visited Iowa State MBA students he talked to them about success. The listeners were surprised by how personal his advice was and how Buffett steered clear of technical talk.

One of the students told USA Today that Buffet taught him "you can't replace the relationships you build and the way you treat people with business knowledge."

Look to the future, not the past.

"Of course the investor of today does not profit from yesterday's growth," Buffett wrote in 1951. His words are still true decades later.

Buffett's warning to investors to look for future growth and not be tricked by unsustainable past performance is helpful when choosing investments.

Don't assume a higher cost equals superior service.

Buffett has always championed passive investing over active investing.

In his 2017 shareholders' letter, Buffett warned that sometimes wealthy people waste money by investing with high-cost investment consultants.

"In many aspects of life, indeed, wealth does command top-grade products or services," he wrote. "For that reason, the financial 'elites' ... have great trouble meekly signing up for a financial product or service that is available as well to people investing only a few thousand dollars."

"Both large and small investors should stick with low-cost index funds," he wrote in a 2016 letter.

Avoid herd mentality.

In 2004, Buffet said, "try to be fearful when others are greedy and greedy only when others are fearful." In other words: buy low, sell high. This advice from Buffett warns of the danger of following the crowd and giving way to herd mentality.

Buffett's longtime strategy is to sell stock when the value is high, rather than scrambling to sell when its low and everyone is fearful that it won't return to its high value.

Know when to cut your losses.

Knowing when to quit is an important trait Buffett learned as a teen trying to recoup his losses at a horse track. After losing once, a young Buffett tried to come out even by betting again, only to lose twice as much as his initial investment.

Sometimes, trying to get out of a hole will only get you into a deeper hole and Buffett suggests that you should often consider cutting your loses to prevent further trouble.

Don't focus too much on the money.

Buffett doesn't want people to focus too much on how much money they have. Being rich is nice, but how you get there — and the people who help and support you along the way — is what matters the most.

"I tell college students, when you get to be my age you will be successful if the people who you hope to have love you, do love you," he said.

Source: BI

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.