- Home

- >

- Fundamental Analysis

- >

- Poor inflation and low interest rates remain dominant

Poor inflation and low interest rates remain dominant

In order to get an idea of what the state of the world economy will be tomorrow or years later, we need to look back and understand how we have reached the current situation. Under the "current situation" we understand today - the world of ultra low interest rates. Accompanied by rampant populism and hostility to the principles of global market economy.

Surprisingly, but by 2009, the Bank of England has never yielded loans to banks at short-term interest rates below 2%. That was enough to handle the state with the Napoleonic wars, two world wars, and the Great Depression. Still, over a decade, interest rates have remained close to zero. The US Federal Reserve has managed to raise the benchmark interest rate of 2.5%, and it's hard. The European Central Bank still holds interest rates close to zero as well as the Bank of Japan. Japan, however, fails to keep its inflation above zero. Poor inflation is not the only problem of the "Country of the Rising Sun".

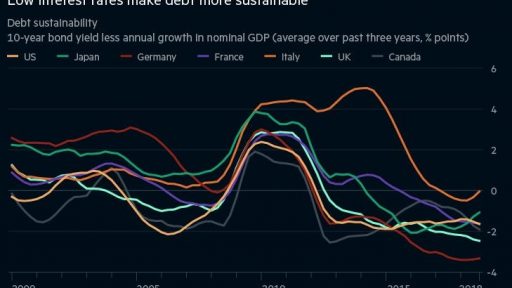

However, we should not be surprised by the current situation of: low inflation and aggressive monetary policy, which includes central bank asset purchase programs and long-term bank lending. Ray Dalio, the founder of Bridgewater has long outlined the logic behind his current position in his book: Principles for Navigating Big Debt Crisis. The key here is that governments whose debt is denominated in their own currency can cope with the consequences of a financial crisis that is caused by excessive levels of debt. In particular, they can "extend" their monetary activities for years, thus avoiding financial depression, precisely caused by the bankruptcy of banks. Dalio calls this "Beautiful Debt Reduction". This is achieved by combining several elements: Restraint regime, debt restructuring and total bankruptcy. An important milestone in debt reduction is the maintenance of long-term interest rates under the growth of net income. This is quite successful in Italy.

Even if so much needed policies are successfully adopted and implemented, they will always be poorly adopted. Mostly after the consequences of a financial crisis. Crisis followed by weak growth usually upset public masses.

What is our situation at the moment? Not in what we need. The answer lies in three aspects. First, although corporate and household debt has dropped relative to the income of developed economies, this does not apply to governments' debt. Secondly, the trans-Atlantic crisis has triggered "debt explosions", especially in China. Third, the economies hit by the financial crisis are still far from their pre-crisis levels. Growth in productivity remains still quite low. Finally, populism remains. The conflict between the left and right goes in full force.

What next? In order to answer this question, we need to think not only about the current pre-crisis conditions, but also about what happens next. The world is currently in a low-interest environment that precedes a financial crisis. Larry Summers has described this phenomenon known as "permanent stagnation." The decisive moment was during the Asian financial crisis, after which the largest economies in the world became exporters of "capital". But there are other factors to consider: High interest rates on savings in emerging economies, systematically low productivity in developed economies, aging economies, and fading demand for physical capital. Let us not forget the de-industrialization of the economies with the highest incomes. We also need to take into account the sharp fall in commodity prices and the displacement of cash flows (mainly income) towards profits and high paid labor. This generally changes the balance between potential earnings and desired costs. This leads to a decrease in interest rates.

Even the financial crisis was the result of this environment. Low interest rates triggered a rise in property prices and triggered an "explosion" of debt, mostly in Europe and the United States. These debt balloons moved the main demand in early 2000. They proved to be unstable, vindicating the world of crisis. But it is not the end of the world. The interest we are seeing today demonstrates this sustainability.

We can divide the last two decades into two periods. "Pre-crisis stagnation" - so described the world of low interest rates and strong, destabilizing credit and mortgage balloons. "Post-crisis stagnation" is the world of interest near zero, partial debt reduction, weak growth and persuasive populist policies.

This raises the question of what the next period would look like? Will the world economy move towards something more stable? Or risk new shocks from a new debt crisis and political instability. And what is the political response to the new threats?

Източник: Financial Times

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.