- Home

- >

- FX Daily Forecasts

- >

- Weak economic data Asian session! Here’s where to look for profits

Weak economic data Asian session! Here's where to look for profits

During the Asian Stock Exchange session, important economic news will be missing, which will push markets significantly, suggesting low volatility and good prerequisites for intranight trade.

Given the mood of the market and the strength of USD during the US and European session today, I expect NZD/USD to provide the best prerequisite for positioning with the main bearish trend. After the US session (23:00 GMT) in early trading in Asia, expect most banks to collect intraday profits of USD, leading to a corrective impulse in NZD/USD. Let's look at the H4 and we predict the entrance:

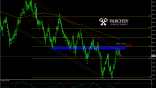

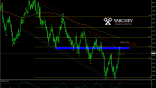

NZD/USD -H4 - technical view (main chart):

After the corrective wave, a Head And Shoulders formation has been formed, which has been activated over the past two days. After a successful test of the Neck Line (in the blue zone), the price forms a "absorbing bar" formation, and is currently adjusting upwards. 50 and 200SMA remain bearish despite the correction - the trend remains in place. DeMarker is in a neutral zone and does not signal until Sequential counts down 2 - a signal to start a new downward wave.

Positioning - input options are two, aggressive now and conservative after a 50% test of the swallow bar at a price of 0.65303.

SL: 0.65502

Alternative Scenario: Passing the price over the line will break the negative scenario and we are more likely to see a pair increase.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.