- Home

- >

- Daily Accents

- >

- What are the moods on the market after the opening on Wall Street

What are the moods on the market after the opening on Wall Street

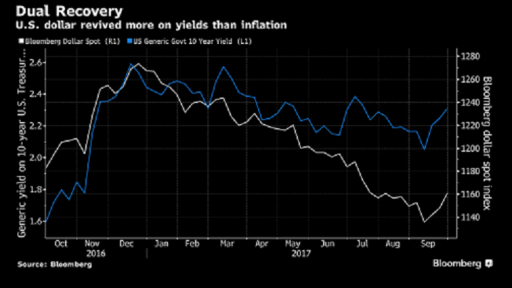

U.S. stocks rose at the open and remained on track for their eighth straight quarterly gain, while European shares headed for their best month of the year. The dollar dropped after a key U.S. inflation gauge disappointed investors looking for confirmation of another Federal Reserve rate increase this year.

The PCE core deflator rose less than economists expectations in August, deepening concern about the stickiness U.S. consumer prices and what it could mean for the Federal Reserve’s expected interest rate hike this year.

Inflation data today was weak, but Janet Yellen was pretty adamant when she spoke that they’re going to remain on course, and even though the numbers missed expectations today the headline number is still the same level, so it’s not a big downtick,” Michael O’Rourke, chief market strategist at JonesTrading Institutional Services LLC.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.