- Home

- >

- Daily Accents

- >

- What can we expect from Mario Draghi’s speech?

What can we expect from Mario Draghi's speech?

As economists watch the European Central

Bank inject three-quarters of a trillion euros into the

financial system this year, they can while away the time by

looking out for a change in language from Mario Draghi.

The ECB president is likely to insist that quantitative

easing must continue to safeguard the euro area’s recovery when

he speaks after the Governing Council sets policy on Thursday.

But with an inflation pickup causing alarm in Germany, he may

also be asked when he might describe the risks to the price

outlook as “broadly balanced” -- a judgment he hasn’t made in

more than two years.

The Governing Council’s first policy decision of 2017 comes

six weeks after Draghi declared the threat of deflation to be

almost vanquished, and will probably mark the start of a year in

which the pressure continually mounts for officials to discuss

if and how stimulus should be withdrawn. In a sign that the mood

is gradually changing, Executive Board member Benoit Coeure

acknowledged last month that the balance of risks to inflation

is “shifting.”

The policy decision will be announced at 1:45 p.m.

Frankfurt time, and Draghi will speak to reporters 45 minutes

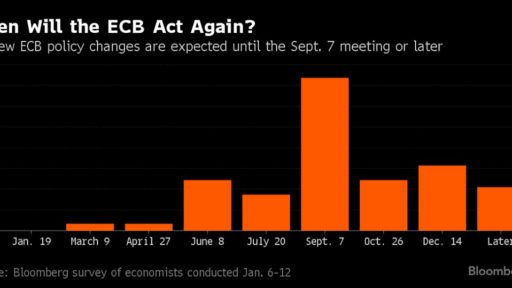

later. All economists surveyed by Bloomberg predict the central

bank will keep interest rates unchanged. Monthly asset purchases

should stay at 80 billion euros ($85 billion) until March and 60

billion euros from April to December.

Political Uncertainty

One of Draghi’s defenses is likely to be that the region

faces an unusual degree of uncertainty in 2017. Economies

including Germany, France and the Netherlands will hold

elections in which euro-skeptics might gain increased support,

and the U.K. is set to start formal talks on leaving the

European Union. A further risk comes from any protectionist

action by Donald Trump, who will be inaugurated as U.S.

president on Friday.

The ECB chief’s remarks will likely contrast with those by

his U.S. counterpart Janet Yellen. On Wednesday she said the

U.S. economy is “close” to the Federal Reserve’s objectives and

she’s confident it will continue to improve, warranting a

gradual reduction of monetary support.

Draghi and Yellen’s actions will feed into a wider debate

over whether central banks are being too cautious in normalizing

policy. That discussion surfaced again this week at the World

Economic Forum in Davos, Switzerland, where former Bank of

England Deputy Governor Paul Tucker warned against allowing

unelected monetary officials to intervene too much in the

economy.

“How central banks conduct themselves is of the utmost

importance now,” he said. “The people will not forgive us if

there’s another crisis.”

The headline inflation rate for the euro area last month

was the highest since 2013, and almost twice as high as in

November. German inflation jumped to an annual 1.7 percent,

sparking media outrage. Bundesbank President Jens Weidmann has

said the ECB should “tighten the reins” as soon as feasible, and

an account of the last policy meeting highlighted disagreements

over the proposal to extend QE.

Even so, the ECB remains well short of its goal of price

growth just under 2 percent, and has expressed concern that the

increase so far is largely due to oil. Core inflation picked up

only slightly to 0.9 percent and policy makers said last month

that they still see no convincing upward trend.

There is little sign that the Governing Council is ready to

endorse more hawkish language just yet. Austria’s Ewald Nowotny,

France’s Francois Villeroy de Galhau and Executive Board member

Yves Mersch have all indicated that they see worries about a

return of inflation as exaggerated.

“To me it’s clear that the ECB wanted to buy some time to

get out of the headlights for a while,” said Anatoli Annenkov,

an economist at Societe Generale SA in London. “But once we’re

past that policy uncertainty in the spring, I don’t see any

reason why we wouldn’t be discussing the pace of balance-sheet

expansion again by mid-year.”

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.