- Home

- >

- Daily Accents

- >

- What can we expect from Fed’s meeting, today at 20:00 (GMT+2)

What can we expect from Fed's meeting, today at 20:00 (GMT+2)

Barclays commenting on what to expect from the FED FOMC.

The Federal Reserve will not change the interest rate on Wednesday, nor will it offer anything specific to explain the future of monetary policy, but the change in interest rates will be what investors will observe.

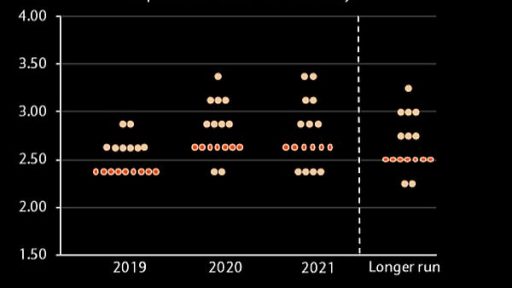

The new FED's dot plan will have the biggest impact. The December forecast predicted a path to rising interest rates, with two rises in 2019 and one in 2020.

Estimates are the forecast to be pruned, but the question will be how much more accurate?

Barclays sees two possible scenarios:

- We expect the Federals not to include this year's interest rate increase and only one increase in 2020. The slow pace of monetary policy will imply a second rise in interest rates over the next two years, but only if inflation stays above the target of 2 % or the US economy is once again showing strong performance.

- We also expect a more moderate approach - with one increase this year, but we will have interest rates in 2020. However, we maintain our basic view that the FED will once again raise interest rates this year and once more in 2020.

In terms of rhetoric, the bank expects Federative to change the description of the lucky economy to "well-performing" by "strong", anticipating a slowdown in growth, despite expectations to stay ahead of trends.

The market will particularly monitor changes in the Fed's balance sheet. The market expects to confirm the Fed's intention to shrink it by the middle of this year.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.