- Home

- >

- Daily Accents

- >

- What comes after “Trump trade” in the stock market

What comes after "Trump trade" in the stock market

The “Trump trade,” which defined the market in the weeks following the U.S. election, is over. So now, stocks will focus on the only thing that really matters over the long term: earnings.

“After S&P 500 companies delivered a record-high EPS of $31.28 in 4Q16, we are expecting growth to accelerate further to >10% in 1Q, highest growth rate since 2011. Additionally, company guidance activity has been encouraging YTD, which reflects strengthening global growth, healthy labor market as well as strong business survey data and consumer confidence.”

“Uncertainty around the upcoming French election and lack of clarity on timing of the US tax reform could continue to weigh on the market in the near term,” Lakos-Bujas writes.

“The market is likely to remain resilient and supported by the Trump and Fed ‘puts’ as well as the continued improvement in the fundamental backdrop both domestically and abroad. If anything, we see a confluence of conditions potentially coming together in the months ahead and setting the stage for the market to reach new highs.”

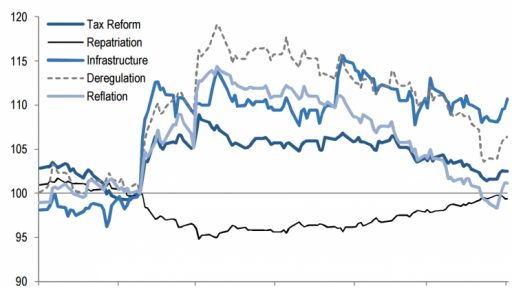

Following Donald Trump’s presidential election win, big bets were made by investors on stocks set to gain — or lose — from economic policies touted by Trump during the campaign. Namely, lower corporate taxes, big infrastructure spending, slashing of regulations (particularly in banking), faster economic growth, and more restrictive trade policies.

But we are now a bit more than two months into the Trump presidency and so far little progress has been made by the administration on any significant piece of legislation related to these goals.

Accordingly, investors have pared their bets, as this chart from JP Morgan shows.

Source: Yahoo Finance

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.