- Home

- >

- Daily Accents

- >

- What does the Fed funds futures suggest about today’s meeting

What does the Fed funds futures suggest about today's meeting

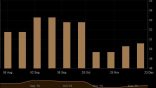

Fed Funds are still showing an 18% chance of a 50 basis point decrease today.

I suppose so, because in part, the expectation is that the Fed will make more than one reduction for the year, so I wouldn't pay much attention to it. Pricing suggests that the central bank will cut interest rates three times by 1H 2020.

In my estimation, the dollar's performance over the last week is more than indicative of expectations before the meeting, as markets begin to lean more toward the fact that the Fed's decision this week will be a one-time scenario.

25 basis points seem guaranteed, the question is will there be more?

At this point, offering 3 reductions by 1H 2020 is a little too aggressive in my opinion because there is not much evidence to support the Fed taking this path.

Of course, there are concerns here and there about the economy - which still performs better than its competitors, which may put the bank in a more aggressive cycle, but what does this mean for the rest of the world?

As the meeting approaches today, he has this feeling of deja vu again, with dollars seeming to be the best of the bad ones.

However, knowing the Fed, they will try to gather as much flexibility as possible in their options, even if they do not have to use them.

In such a situation, they will reduce interest rates today and leave the door open for an additional flexible option that they may require later in the year.

At the same time, they cannot return to their previous communication, so I think they will leave room for more reductions in the future, but will stick to data dependence in the coming months before deciding to do so.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.