- Home

- >

- FX Daily Forecasts

- >

- What does the options market tells us for the Pound and Brexit expectations?

What does the options market tells us for the Pound and Brexit expectations?

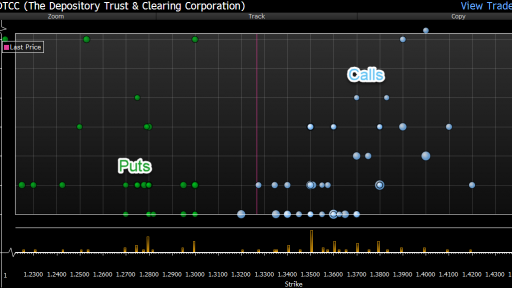

Investors are starting to make huge bets that pounds will rise sharply in the next month because they expect Brexit to be bounced.

The new positions in support of the pound, with an expectation to appreciate in April, amounted to $ 4.5 billion in options, which has accumulated since last week, doubled more than seven days ago. Hedge funds add call options, looking for profit from the rally.

The pound has already risen 4% since the beginning of the year, making it the best-performing base currency. Traders have grown bullish after the chances of leaving the EU without a deal on March 29 fell dramatically. EU representatives intend to propose an extension of Brexit at their meeting this week in Brussels after the Parliament spokesman blocked Theresa May's request to propose its voting agreement for the third time in a row (it should have been today).

"The option market does not appreciate as much no-deal risk as the potential long-term extension of Brexit or a deal." - says Adam Pickett, FX strategist at Citigroup. "This supports our view that if there is a strong movement, the chances of it being higher are bigger."

The number of new options is £ 100m, which is an increase to the pledges for a rise in the price of the pound, as much as a decrease. The largest group of new positions are call options expiring in April, including one for GBP 877 million with a strike of $ 1.38, which is 4% above current GBP / USD.

"Increased demand for huge call options means that the market is in a position where it expects some kind of soft Brexit, which suggests that Cable will rise to $ 1.35 - $ 1.40." - says Vasileios Gkionakis, chief currency strategist at Banque Lombard Odier & Cie.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.