- Home

- >

- Cryptocurrencies / Algotrading

- >

- What happen to Bitcoin and what’s next?

What happen to Bitcoin and what's next?

If the crypto market sentiments weren’t depressing enough, regulatory news and chatter from all around the world are indicating tough times ahead for cryptocurrencies. Bitcoin is taking continuous blows and recovery seems pretty tough. But what caused this situation and how much damage has been done?

The world’s first and largest cryptocurrency Bitcoin is famous for being the decentralized peer-to-peer network. The idea of not depending on any governing authorities’ networks and not being controlled by any person is why Bitcoin is believed to be perfectly designed for hassle-free payments and money transaction between two people. Bitcoin’s anonymity has attracted the attention of many entrepreneurs and crypto enthusiasts who developed altcoins based on bitcoin’s technology aiming to perfect its functionality. Bitcoin has now spread across the globe and is being used for payments as well as trading another crypto.

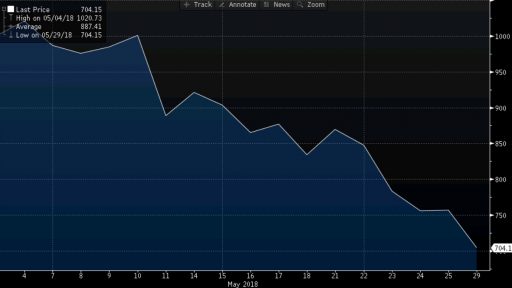

The major reasons that might’ve caused the current bitcoin market condition are; initial Mt Gox sell-off which made bitcoin lose $9,000 USD footing, the recent scandals which shot down Upbit, biggest cryptocurrency exchanges of South Korea and also the recent Bitfinex taxation policy which is under extreme criticism by crypto investors worldwide.

Even at the current crypto market’s slump, there’s no denying that Bitcoin still holds the place of the biggest cryptocurrency of the world. The individual price has dropped to approximately $7,340 USD. the current position is still miles away from recovery point and analysts say that unless BTC crosses the barrier of $8,500 USD, there won’t be any bullish breakouts. It is still uncertain whether bitcoin prices will manage to recover from the current market trends and reaches the resistance level.

Undoubtedly, Bitcoin markets are presently under red zone and there’s no guarantee as to when and how it’ll climb back up towards recovery so that Bitcoin holders may get over the damage. But many traders look at this opportunity to get in the game and hold their Bitcoin in hope for collecting profits in the long run. Like the thumb’s rule of crypto trading goes, ‘buy the dip’ it isn’t that of a bad idea to buy Bitcoin. But one of the many reasons newcomers in the crypto markets are hesitant of buying crypto during a slump is because there’s no telling when the dip will be over. All we can ascertain with trading charts and sentiment analysis is that the market will be rushing towards recovery very soon.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.