- Home

- >

- Fundamental Analysis

- >

- What is priced in for the markets before FED decision

What is priced in for the markets before FED decision

Many market players rely on two tools to measure the likelihood of interest reductions by the Fed. At the moment, these two instruments show multiple signals.

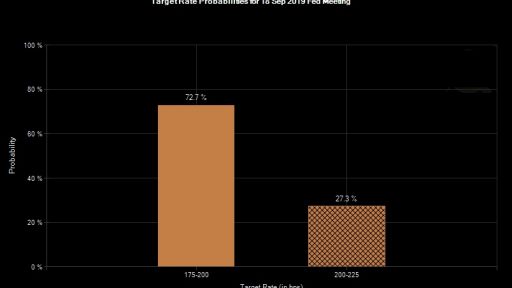

The CME Fedwatch tool shows a 27.3% chance of nothing happening today. It had reached 52% yesterday.

The other indicator is Bloomberg - WIRP. It shows a cut for today within 50 points with a probability of 14%. Last Friday, he showed a 97% chance of a cut in general and only 3% for a 50-point move.

Both indicators send mixed signals. The problem here is that they value short-term changes in interest rate futures, which confuses the markets further. The effective fed fund rate reached 2.30% today from 2.14% earlier in the week.

Markets are currently reflecting the likelihood that the Fed will stick to the lower limit of the range. The October futures are trading at 1.89% at the moment, which is 1.5 points above the average acceptable value of 1.75 - 2.00%. That's exactly 25 points below Friday's effective federal fund rate.

What has been evaluated so far in reality?

At this point, we're talking more about art than science, but whatever was assessed last Friday doesn't matter anymore after the failed Fed repo move from yesterday. That leaves the chances of a cut at 97% with a partial chance of no action today. The situation with Saudi Arabia has raised the chances of a deeper decline, but keeping oil prices high helps to keep inflation afloat. In this case, geopolitical risk balances the economic situation.

What is more interesting is what is being estimated in October, and the signals from the Fed funds rate futures will dictate the mood of the markets next month.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.