- Home

- >

- Fundamental Analysis

- >

- What the Bank Reports Show – Buy or Sell

What the Bank Reports Show - Buy or Sell

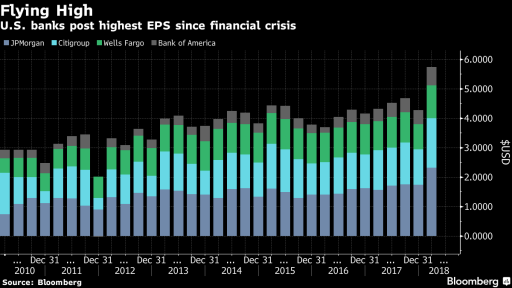

In short - Banks succeeded!

The high volatility of the markets has led to an increase in share trading income, and rising interest rates have helped lending. On the other hand, corporate tax cuts have strongly supported the big Wall Street players such as JP Morgan Chase & Co., Wells Fargo & Co., Citigroup Inc. and Bank of America Corp.

By the end of the week we expect Goldman Sachs and Morgan Stanley to publish their reports. Here are the up-to-date trends and what we can expect:

Trading in shares

Big Wall Street banks have once again proved that high volatility is conducive to stock trading. JP Morgan has achieved record revenue in equity trading, while Bank of America and Citigroup generate the most money since 2010.

Fixed yield

One at the expense of the other. Better trading outcomes are overshadowed by the return on trading of fixed-income instruments. However, the balance remains positive. Here are the figures:

Interest income

JP Morgan, Bank of America and Citigroup took advantage of the fact that the Federal Reserve has raised interest rates twice in the past four months, meaning that they can recalculate interest on loans that is directly linked to the country's main interest rate. All three companies reported higher net interest income in the first three months of the year.

Credit quality

Credit quality remains a major concern for investors, as the Federal Deposit Insurance data show that credit card debt has reached a record last year.

Mortgage

The increase in interest rates usually damages mortgage lending because housing loans become more expensive and discourage buyers. This also proved true in the first three months of the year, when the two largest US homeowners began to feel the effects. Wells Fargo applications for new loans declined relative to the fourth quarter. JP Morgan's claims fell 25 percent to $18.2 billion.

Bank Of America even stopped publishing its mortgage business data. The revenue line, which regularly reached $ 1 billion. per quarter is now so small that the bank puts it in the "All Other Revenue" column.

Source: Bloomberg Pro Terminal

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.