- Home

- >

- Stocks Daily Forecasts

- >

- What this week’s stock market will tell you about 2017

What this week’s stock market will tell you about 2017

Relax. The next week tells you nothing about whether the stock market will be higher or lower in 2017.

Many on Wall Street believe the contrary. Perhaps the most well-known manifestation of this belief is the saying that “if Santa fails to call, bears may come to Broad and Wall.” The reference is to the Santa Claus Rally period that encompasses the week immediately after the stock market’s Christmas break. (The intersection of Broad and Wall Streets is immediately adjacent to the New York Stock Exchange.)

Try as I might, however, I can’t find any support for this. If anything, in fact, there is some very modest evidence that the stock market actually does better if the market falls between Christmas and New Year’s.

Consider what I found upon examining the Dow Jones Industrial Average DJIA, +0.07% going back to 1896, when it was created. I was looking for any correlation between the market’s direction over the seven trading days after Christmas with its direction over the subsequent six to 12 months. I came away empty-handed.

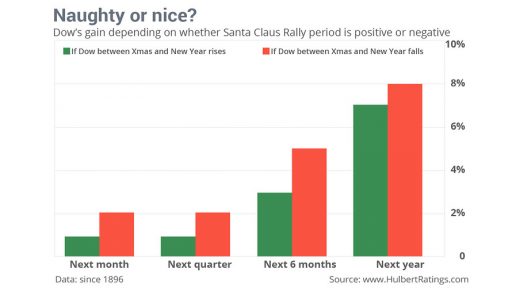

Particularly telling are the data summarized in the chart that accompanies this story. Notice that the stock market on average over the last 120 years has done better over the subsequent month, quarter, half-year and full year following Decembers in which Santa Claus “failed to call” on Wall Street.

This inverse correlation certainly was the case over the past year. The Dow fell nearly 4% over the seven trading sessions following Christmas 2015, making it one of the worst Santa Claus Rally periods for the stock market since 1896. Since then, however, the Dow has gained nearly 18%.

To be sure, the differences plotted in the chart aren’t significant at the 95% confidence level that statisticians often use to determine whether a pattern is genuine. So you shouldn’t actually wish for a declining market over the next week.

An even more appropriate conclusion to draw is that you shouldn’t worry any more about the market’s direction over the next week than about any other week of the calendar. The notion that the next week has special forecasting significance is yet another urban myth.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.