- Home

- >

- Daily Accents

- >

- What to expect from Bank Of England today – 14:00 GMT+2

What to expect from Bank Of England today - 14:00 GMT+2

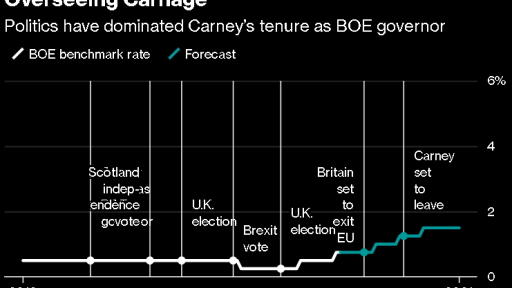

Today, we expect the Bank of England decision to base the UK interest rate. Currently, the central bank has a good reason to raise interest rates, but given Brexit, it is definitely not the time.

Since the Brexit talks are still panting, and March 29 is approaching, the central bank is likely to take a cautious stance, leaving interest rates unchanged. While members adhere to the line of limited and gradual upgrades, economists do not see a change in the state of the economy, so they expect the CB to stand in Stand By.

This means that the focus will fall today on Mark Carney's press conference and the bank's latest economic forecasts.

Since August, economic reports have confirmed BOE's arguments for action, with data showing that expansion has been the fastest in the past two years. There are also signs of a long-awaited increase in wages, the growth of which is the highest for almost a decade.

What economists say ...

"Life without Brexit would be blessed simple for Bank Of England, and in the negotiations that show little progress, the central bank will probably look beyond the positive flow of data for the moment." If a deal is reached, there may be an increase in interest rates May. "

Regardless of better data, the market is becoming more pessimistic in terms of raising the interest rate, due to the uncertainty surrounding Brexit and the turbulence in global markets. Investors stopped accumulating the next possible interest rate rise in 2019 as Brexit's probability of finishing a good UK deal fell to 40%, from 90% in less than 2 weeks.

On the chart below, you can track the mood gap among traders with precision:

Brexit Impact?

BOE members agree that the form of "Brexit" may rewrite their perspective and this would mean an increase in the rate or cuts in the basic interest rate.

The new forecasts we expect today, based on the average value of a number of smooth results scenarios, will almost certainly have to be reconsidered. The impact on the pound will be limited to about 1 percentage point difference in the BOE forecast for inflation, according to Bloomberg Economics.

What to expect from BOE In terms of GDP?

Even without taking into account the latest stalemate in the Brexit talks, officials may still focus on lowering growth forecasts over the next two years. None of the 15 Bloomberg surveyed economists expect the central bank to increase its growth projections in 2019 and 2020 - currently 1.8% and 1.7%.

What can we expect from GBP today?

Undoubtedly, there will be no volatility, and this will give good prerequisites for scalp trade and quick intraday gains. If tonight, during Mark Carney's speech, is calm and optimistic, I expect GBP to continue to grow until the end of the week, with a test of the area around 1.2920 remaining the most likely scenario. If, however, the central bank's forecasts prove to be bad, the GBP sellouts will again be in vogue, and the weekly bottom test, the most likely scenario.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.