- Home

- >

- Daily Accents

- >

- What to expect from FED today at 21:00 (GMT+3)

What to expect from FED today at 21:00 (GMT+3)

Today at 21:00, the Fed will decide on interest rates in the US, with the expectation that there will be no change from the current 2.5%. Although interest rates are one of the most important economic news, today almost no one seems excited about how much of this. The interference of the politics of the markets and somewhere shifted the focus of the traders from central bank decisions to twitter speeches, rumors and the like.

Investors' attention will not be as direc- tive at this point as to the almost-determined outcome of the rate decision, but rather on the balance sheet and the guidance that will be announced at the press conference 30 minutes after the interest rate decision.

If the tone of the press conference suggests additional dovish moods by the Fed, it will be negative for USD and positive for risky assets. Alternatively, if central bankers hint at preserving the course of monetary policy, it will be highly positive for the dollar and may shake all time high levels at US indices and other risky assets.

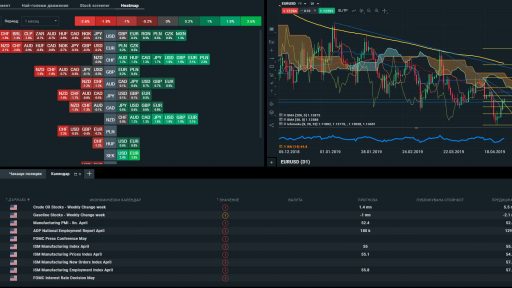

If we look at the EURUSD, the price has returned above the key level of 1.1215, but the price has many more obstacles to overcome before we have reason to believe that the downtrend has been exhausted. The USD correction may be due to caution against new purchases and profits before a major release.

Levels around 1.1260 are very likely to withstand and see an expensive dollar unless the FED signals extreme dovish moods, which at least for now remains the less likely scenario.

A little earlier in the day, we expect data for ADP Nonfarm Payrolls, which is very often used as a landmark for the upcoming NFP on Friday. This combined with many closed markets is a recipe for low volatility at least until the news at 15:15.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.