- Home

- >

- Daily Accents

- >

- What to expect from NFP today at 15:30

What to expect from NFP today at 15:30

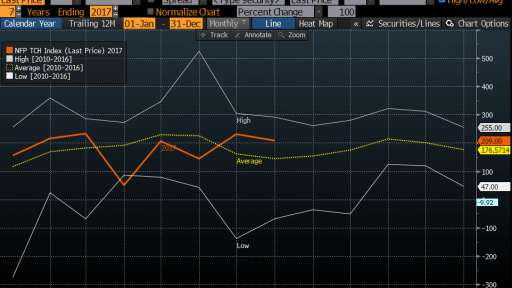

For the past 7 months, in 5 of them, NFP data was above expectations during 2017. The average increase in new hired workers is 184,000, which is almost as high as last year's 187,000 and above the average increase over the past 8 years.

Permanent demand for labor has pushed unemployment levels to a record low and attracts more Americans to seek employment. But if the labor market continues to expand at such a rate, the economy will eventually reach full employment, as it is currently thought, and this will lower the expected NFP data.

Factors influencing the excellent performance of the labor market are many: Hopes that Donald Trump will reduce taxes, positive business sentiment, rising consumer spending, oil price stabilization, improved export market. In the last few months, we have noticed that newcomers are in less paid sectors such as restaurant, healthcare and hospitality services.

On this report we will not see the effect of Hurricane Harvey. Almost all of the upcoming NFP data has already been collected when the hurricane struck.

According to Bloomberg's latest forecasts, the labor market will expand by 180,000 jobs, down from a July 209,000 drop.

It is very likely that the market will not respond so strongly to NFP data as to the change in the in average hourly wage. As the economy is almost in full employment, and the change in the NFP is more likely not from newcomers, but for those who change their jobs. On the other hand, in recent months we have seen minor changes in the wage increase, which is in fact the main driver of the economy. If Average Payments data is below expectations, we will probably see a strong weakening of the dollar and an increase in indices. If NFP data is "off the charts," we're likely to see an increase in the dollar, but the main engine will remain the hourly pay.

For the upcoming report, analysts have different opinions, but most expect the NFP to show a decline. Jim O'Sullivan of High Frequency Economic expects a 20,000 drop. Moody's rating agency also expects a decline. Big banks, Citi and Goldman also believe the data will go below expectations. UBS, on the other hand, are expecting an increase.

On the chart below, we see that since the beginning of this year, the growth of newcomers in the non-agricultural sector has been strong and increasingly optimistic.

Source: Bloomberg Pro Terminal

Trader Bozhidar Arabadzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.