- Home

- >

- FX Daily Forecasts

- >

- What to expect from RBA today and how to position yourself at AUD

What to expect from RBA today and how to position yourself at AUD

Later today, at 03:30, we look forward to the RBA report on Australia's economic environment and monetary policy. The report is often published, and it is not typical for the Australian to support it. That is what investors are looking for at the moment, which are mainly focused on sales of AUD.

Traders will turn their attention to looking for signs that RBA is considering tightening monetary policy and whether the bank has changed the assessment of the country's economic environment. Expectations for the report are negative, which will be in favor of the bears.

Where to position yourself to maximize profits?

Far from Australia, but growing tensions between the US and Saudi Arabia provide a very good prerequisite for CAD, as the Kingdom is one of the largest oil producers and the Canadian is still in correlation with it. Disputes between Saudi Arabia and the United States are still on the rise, and the potential for spreading a major scandal is not small. Considering the negative expectations for AUD and CAD positive, it is good to head to AUD/CAD, which reached key levels of resistance after the gouge formed two weeks ago.

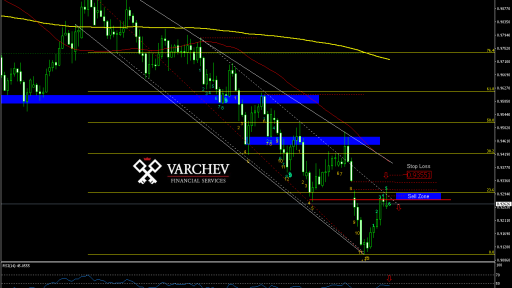

Let's look in detail - AUD/CAD - D1

Our Expectations: Ability to shorten after a bearish pin bar test formed in the resistance zone. SL: 0.93551

Alternative Scenario: If the price moves above the resistance zone and stays there, the negative scenario will break and we are more likely to see a price increase and a 38.2% Fibonacci test of the main trend.

Comment: The price is in a long-term downward trend and after correction to a resistance zone formed by horizontal resistance, downward diagonal and 23.6% Fibonacci trend correction. Price Action: This is obvious. First we have a gaff after the NAFTA decision two weeks ago, and yesterday, in a downward direction, caused by geopolitical tension. There is a bearish pin bar zone of resistance - negative for the price. RSI remains below 50 - the trend remains in place. DeMarker counts 6 on top, indicating that short-term upward pulses are possible.

Positioning: Should be after a 50% correction of the pin bar and SL above the resistance zone. SL: 0.93551.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.