- Home

- >

- Commodities Daily Forecasts

- >

- What to expect from the metal market

What to expect from the metal market

The Chinese economy has a strong influence on the metal market due to the country's varied production. In order to maintain the productivity of the economy, import of various metals is needed, a decrease in Chinese imports has a strong impact on the metals market. Currently, Chinese productivity is threatened by the US-China trade war.

Because of these fundamental factors LMEX of six industrial metals has dropped by 7% over the past four weeks. For the index, this is the worst period for the past two years. The previous metal market collapse was caused by the devaluation of the Chinese yuan, resulting in a seven-month crash in the metals market.

Now the downgrade of the market is caused by the escalating tensions between the world's two most profound economies. Donald Trump asked the US Treasury Department to impose import tariffs on Chinese goods at 10% and worth $ 200bn. Trump's latest action in the conflict is to take steps to prevent China Mobile Ltd from entering the US market. Relations between the two countries are becoming more and more strained.

In the past weeks, the China Department of Commerce has announced that it will take action to counter the US. But they are limited to the extent of the repressive tariffs they can apply because they do not import as much American goods as the US accepts from Chinese products. China has imported only $ 129.9 billion from the US in 2017, compared with $ 505.5 billion in exports.

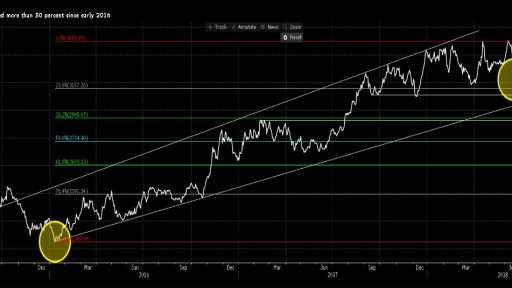

According to the technical situation, the price breaks the level of 3173 points, the next stop of the price is a dynamic diagonal level. Reaching to him, we will look for a Price Action signal, and a breakthrough, test and repulsion from the level will result in numerous short positions.

Chart: Used with permission of Bloomberg Finance L.P.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.