- Home

- >

- Daily Accents

- >

- What to expect from the new Fed dot plot on interest rates

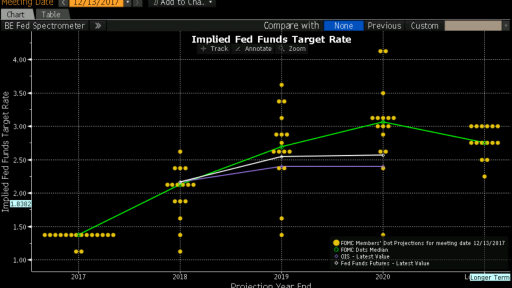

What to expect from the new Fed dot plot on interest rates

The Federal Reserve is expected to get more hawkish next week, but only around the edges.

“It is not a bold forecast to argue that there will be a hawkish undertone from the meeting...[but] they will be baby steps rather than moving in leaps and bounds,” said Michelle Meyer, senior U.S. economist at Bank of America Merrill Lynch, in a note to clients.

Meyers said the Fed is likely to stick to its December forecast of three rate hikes.

Fed Chairman Jerome Powell sounded upbeat in his testimony about the outlook to Congress last month, saying some of the headwinds holding back the economy were now tailwinds. The Trump tax cuts and then plans to increase government spending may force the central bank to be a little more aggressive to keep the economy from overheating.

Dean Maki, chief economist at Point72 Asset Management, said he didn’t expect “any significant change in tone” at next week’s meeting. In any case, moving the median is a heavy lift, he noted.

In the last projection in December, only four of 16 Fed officials forecast four rate hikes. To move the median to four hikes next week, four more Fed officials would have to move up their forecast to 4 hikes.

The Fed will meet Tuesday and Wednesday. Following the meeting, the central bank will release new economic projections, an updated dot plot and a policy statement. A quarter-point rate hike is widely expected. Powell will then hold his first press conference.

Meyer said the Fed’s hawkish hint will come in a steepening of path of rate hikes. She expects the Fed to raise its forecast of 2.5 hikes in 2019 to a full three hikes.

Signaling four hikes for 2018 might cause financial conditions to tighten further, “far in advance” of any actual signs of an overheated economy, she said.

There are no need to send a dramatic signal as inflation is under control and first-quarter growth is now expected to be below 2% annual rate.

If she is right, Meyer said the outcome could be good news for the stock market.

Stocks DJIA, -1.16% were volatile last month over concerns the Fed might have to slam on the brakes to cool down inflation.

Many economists see the Fed wait until June to pencil in four hikes.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.