- Home

- >

- Fundamental Analysis

- >

- What to expect from the press conference of Mario Draghi, Thursday, 15:30

What to expect from the press conference of Mario Draghi, Thursday, 15:30

Mario Draghi may be willing to take a faster route to monetary-policy normalization than economists previously thought.

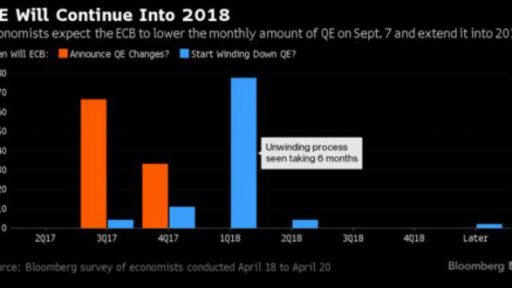

While no changes to interest rates or asset purchases are expected at Thursday’s meeting, most respondents in a Bloomberg survey now say the European Central Bank president will revise forward guidance as early as June, six months sooner than in an earlier poll. Economists also reduced their estimate for how long it will take to taper quantitative easing and brought forward their predicted rate hike.

Public divergences among senior policy makers in recent weeks have fueled speculation that the ECB is close to signaling the withdrawal of its extraordinary stimulus. While Draghi has tried to quash that talk, concerns over the French presidential election eased after the first round on Sunday and the currency bloc’s steadily strengthening recovery may convince him to at least hint at his exit strategy.

“Assuming there are no major shocks, then the ECB will want to start taking the monetary stimulus punchbowl away, albeit at a modest pace,” said Alan McQuaid, an economist at Merrion Capital in Dublin. “It is likely to start with changing its forward guidance after the French election, then announce its tapering intentions after the German election in September and then deliver on bond-buying reductions.”

Thursday’s meeting in Frankfurt might see the official start of an exit discussion that has so far been conveyed only in public appearances and media interviews. Draghi said after the March 9 Governing Council meeting that it wasn’t a topic, and stressed in an April 6 speech that the economy offered no grounds to “materially alter our assessment of the inflation outlook.”

Much depends on France, where the National Front’s Marine Le Pen has campaigned on an anti-euro platform, and did well enough in Sunday’s vote to reach a May 7 runoff. Even so, the single currency surged when the results of early counting showed she’ll meet Emmanuel Macron, a centrist. Opinion polls indicate Le Pen will be easily defeated.

The risk still remains between now and the runoff that her support rises. ECB Governing Council members attending the International Monetary Fund meetings in Washington over the weekend signaled that their liquidity facilities remain available to counter any market tension.

The central bank currently says it expects to keep rates “at present or lower levels for an extended period” and “well past” the end of quantitative easing. Of the 47 economists polled last week, just 8 expect policy makers to tweak forward guidance at this meeting. Even if they’re right, the change would be relatively minor, with all but one saying the ECB would drop its signal that rates might be cut further.

One-third say policy makers will this week describe the risks to economic growth as broadly balanced rather than tilted to the downside, a change that Executive Board member Benoit Coeure said last week he would personally favor.

Once the ECB has kicked off the communication that will lead to the end of QE and ultra-low rates, economists foresee swifter action than they had predicted prior to the last meeting.

More than 60 percent say the winding down of QE will be announced in September this year, with 93 percent expecting tapering to start by the first quarter of 2018, up from 88 percent in the last survey. A majority say the ECB will announce monthly reductions one at a time instead of setting out a full plan, and the median estimate is for the process to last six months, down from seven months previously.

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.