- Home

- >

- Daily Accents

- >

- What to look in upcoming bank statements

What to look in upcoming bank statements

The biggest U.S. banks are about to show how much those uncertainties, and the slide in market volatility, affected third-quarter results and the lenders’ outlooks. JPMorgan Chase & Co. and Citigroup Inc. come first, on Thursday.

Here are some likely takeaways:

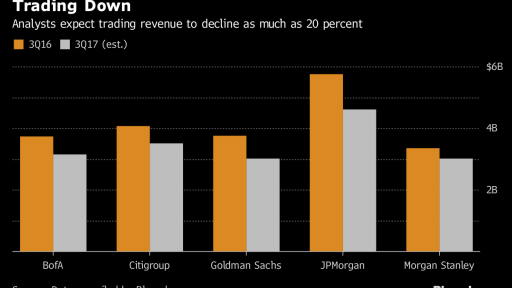

Trading Revenue

Trading probably dropped from the same period a year earlier. Executives from JPMorgan, Citigroup and Bank of America Corp. told investors last month to expect declines ranging from 15 percent to 20 percent. Goldman Sachs Group Inc., coming off its worst first half for the trading business in more than a decade, said the third quarter remained challenging. Subdued volatility, especially compared with the turmoil from Brexit and the U.S. election a year earlier -- made the period particularly tough.

Loan Growth

Lending probably decelerated for the fourth straight quarter, according to Royal Bank of Canada analysts and Bloomberg calculations. Commercial and industrial clients are “hesitant to borrow in the face of uncertainty,” Jason Goldberg, an analyst at Barclays Plc, said of Washington’s inaction after higher hopes earlier in the year. Total loans may have climbed just 1.8 percent, the smallest increase in more than two years.

Bitcoin Battles

The largest cryptocurrency has more than quadrupled this year, a surge that didn’t go unnoticed by executives at the largest U.S. banks. In September, JPMorgan Chief Executive Officer Jamie Dimon called bitcoin a “fraud” that “won’t end well,” while Goldman Sachs CEO Lloyd Blankfein tweeted Oct. 3 that Goldman is examining it.

Credit Trends

Analysts estimate that 17 of the 20 U.S. regional banks tracked by Bloomberg Intelligence may have built loan-loss reserves in the third quarter, up from seven in the second quarter and 12 in the first. According to KBW Inc., credit trends were particularly “noisy” in the third quarter, with cards and auto loans affected by hurricanes while underlying metrics indicate that credit is slowly normalizing.

Tax Cuts

Net income could rise 7 percent annually for the six largest U.S. banks if President Donald Trump and Republicans in Congress can enact their proposed corporate tax cut -- still an open question. The Republican framework calls for lowering the corporate tax rate to 20 percent from 35 percent. Banks stand to benefit from this more than other industries because they typically have fewer deductions.

Headcount

The biggest banks have stopped cutting jobs in recent quarters after headcount bottomed in the middle of last year. Did they start eliminating jobs again, or were there opportunities to add people? Will banks’ relentless push toward utilizing artificial intelligence and automating tasks result in fewer people?

Източник: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.