- Home

- >

- Fundamental Analysis

- >

- What we need to know about the central banks right now

What we need to know about the central banks right now

This is a busy time for major central banks. The Bank of Japan and European Central Bank met last week, the Reserve Bank of Australia and the Federal Reserve meet this week, and the Bank of England meets next week.

Although most major central banks are deciding not to make big changes to monetary policies, global interest-rate expectations among investors have shifted to a tightening bias driven almost entirely by the anticipation of expansionary fiscal policy.

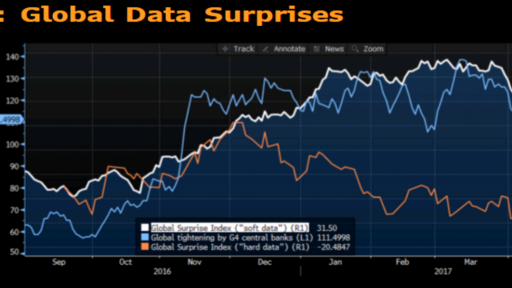

To understand why, you need to first consider the stark divergence between economic data that is based on sentiment and data that is based on actual activity. The sentiment-based, or “soft,” data has consistently surprised to the upside, creating a strong correlation with higher interest-rate expectations. The actual, or “hard,” data such as measures of gross domestic product or factory production has been relatively weak. This divergence may drive central bank policy expectations in opposite directions with consequences for different markets.

One consequence is that inflation expectations as seen in the markets for bonds and derivatives are becoming increasingly volatile. Respondents to surveys suggest that they see faster inflation and some central banks, such as the European Central Bank and Bank of Japan, say they need to take a cautionary

stance when it comes to inflation. But despite an uptick in actual inflation data, market based long-term inflation expectations suggest investors are skeptical central banks can meet their inflation targets.

Also, financial conditions have begun to tighten in some critical places around the world as a result of geopolitical tensions on the Korean peninsula, election uncertainty in Europe, and challenges to U.S. domestic fiscal policy. The ability to tighten monetary policy based on financial conditions can really only be seen in the U.S.

The divergence in financial conditions can be a boon to equities and credit -- high yield in particular -- as investors continue to seek higher returns in a world of zero or even negative interest rates.

Then there is capital flows into emerging markets, where some central banks are easing, such as Russia and Brazil, and others are tightening, such as Mexico, Turkey and China. The diverging policies among emerging-market central banks are visible in real interest rates. The gap between emerging and

developed market real rates has become the widest in more than five years

So, divergences in inflation expectations, financial conditions and real interest rates will continue to shape global central bank policy.

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.