- Home

- >

- Fundamental Analysis

- >

- What will happen to the pound when Article 50 is triggered

What will happen to the pound when Article 50 is triggered

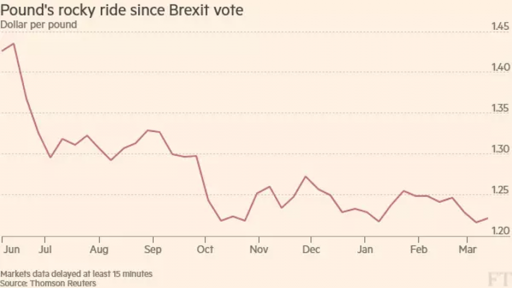

Among the staging posts towards Brexit, the triggering of Article 50, the mechanism that begins the two-year countdown to Britain’s exit from the EU, has been on the calendar of sterling-watchers ever since the referendum.

Investors have struggled to make sense of the politics and economics of Brexit ever since the referendum. A large devaluation in the early post-referendum days prompted gloomy predictions for the pound. At times, the government’s Brexit policy, particularly its confusing communication strategy, left investors flummoxed and so more inclined to be bearish on sterling.

But the economy’s resilience and Theresa May’s more coherent Lancaster House speech on Brexit in mid-January have kept sterling above $1.20 since that threshold was tested in January. Meanwhile, the government’s legal difficulties, which at one stage cast doubt on its Brexit timetable, have been largely forgotten as it has steered its Article 50 bill through parliament.

“The bottom line is that while the UK government has an absolute mountain to climb in its Brexit negotiations it might be navigating the lower slopes with some comfort,” said Steven Barrow of Standard Bank.

It has long been regarded as likely to be a significant market-moving event, but forex analysts now expect the moment itself to have only a modest impact on sterling. Indeed the pound has begun this week with a rise above $1.22 and also gained 0.5 per cent versus the euro to £0.8735. This is in part because investors are no longer in denial about Brexit, and have been pricing in the reality of the coming divorce.

The House of Lords’ proposed amendment asking for a “meaningful vote” on the eventual Brexit deal was the type of news event that last year would have shifted sterling, according to Morgan Stanley strategists. They believe that a lot of Brexit uncertainty is now priced into sterling. “We don’t think that triggering Article 50 will be a big event for the currency,” they said, reiterating their bullish stance on the pound.

Still, Article 50’s trigger will not go unnoticed by investors. Even though it is a sure-fire event, further weakness may ensue, possibly involving a test of the January low. More significant may be the EU’s response in the days after the announcement, and what it says about the negotiations process.

Sterling is considered cheap, given the underlying health of the UK economy, now forecast to grow 2 per cent this year. While that is a buying opportunity to some, a series of factors are also assuming greater importance to investors than the Article 50 trigger.

These include the increasing burden of sterling’s decline on corporate Britain, the risk of Brexit on inward investment, the relationship between Mrs May and other EU leaders in the run-up to official negotiations and the French presidential election. There is also the prospect of US interest rate rises to consider.

Sterling remains weak and, though implied volatility on the pound against the dollar has been falling, that could change if the pound breaks $1.20, according to Société Générale.

The problem for investors is how to judge the progress of what will be two years of Brexit negotiations. Which is why several strategists are reluctant to forecast anything significantly at variance with the pound’s current value during at least the remainder of 2017.

“The longer the uncertainty over the UK’s future trading relationship with the EU lasts, the longer the potential downside pressure on investment spending, employment growth and inflation,” said Rabobank’s Jane Foley.

More likely is that sterling’s direction will be influenced by developments in other countries. For example, there is scope for the pound to weaken against the euro in the coming months, said Ms Foley, if the eurozone economy continues to strengthen, Marine Le Pen loses the French presidential election and the European Central Bank becomes less dovish.

The Wall Street Journal

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.