- Home

- >

- Daily Accents

- >

- What’s next after the strong decline in the stock’s market? Here’s what history says

What’s next after the strong decline in the stock's market? Here’s what history says

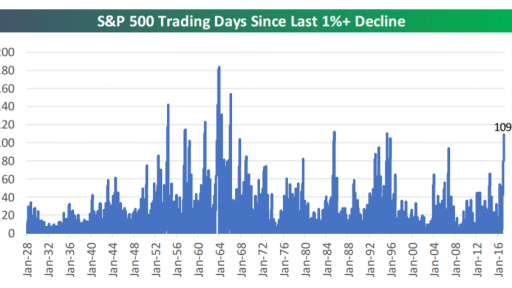

This is the first decline with more than 1% for 109 consecutive sessions from October 11 onwards. Strategists from Bespoke Investment Group reviewed the chart for the period from 1928 onwards, when the S&P500 was increasing without a drop of more than 1% for more than 100 days. (graphic in the left)

The data group have cited only 11 such instances in which trading without a down day hit the century mark, and on average during the week, month and three months following the first decline during those periods, the broad-market S&P 500 tends to end higher.

For the week, the average gain is 0.65%, advancing 8 out of 11 times. The average return after a month is 2.34%, with returns positive in 9 out those 11 occasions. After three months, average returns are about 2.44%, boasting gains in 8 out of those 11 periods (see table below).

To be sure, those statistics may offer no solace (and no guarantee of future gains) to investors fretting that the wheels may be coming off the equity train that has been powered by promises of fiscal stimulus from President Donald Trump. Anticipated delays in his health-care overhaul has led some to fret that the slog toward implementing pro-business policies, including deregulation, tax cuts and infrastructure spending could be longer than initially expected.

But it isn’t exactly clear, beyond lingering concerns about lofty stock valuations, what set off a sharp tumble in stocks on Tuesday, which saw the Dow DJIA, -1.14% fall 237 points, or 1.1%, to end at 20,668, the S&P 500 sink 1.2% to close at 2,344.

To many, the market selloff was overdue. But it is hardly anything to write about because as Salil Mehta, a graduate school finance professor, who has worked at Georgetown University and New York University, has noted, stock markets normally decline by least 1% once every 6 sessions.

The four-month period without a drop for the Dow and S&P 500 was uncanny and historic, but may provide some brave souls with buying opportunities, while others wait for the next shoe to drop.

Source: MarketWatch

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.