- Home

- >

- Daily Accents

- >

- When will the Fed raise interest rates?

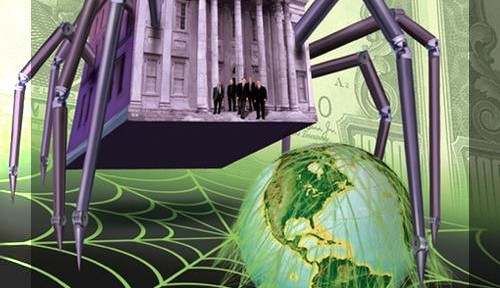

When will the Fed raise interest rates?

With the Federal Reserve set to hold its monthly policy meeting this week, the debate among central-bank watchers on whether the world's most influential central bank will raise interest rates has intensified.

According to a poll by Reuters in August, the Fed is widely expected to raise short-term interest rates for the first time in nine years as early as September amid improving economic fundamentals in the U.S. But an abrupt devaluation of the yuan by Chinese authorities in August and renewed turmoil in global financial markets has had some market watchers paring back their forecasts.

Former Treasury Secretary Larry Summers is one of the market watchers calling for a delay in the rate hike on the back of growing financial market volatility. Summers also cited subdued inflation and a low labor force participation rate in the U.S. as reasons for the Fed to hold fire for now.

Meanwhile, the World Bank's chief economist has joined Christine Lagarde, managing director of the International Monetary Fund, in warning that a rate rise could trigger "panic and turmoil" in emerging markets.

To be sure, there are still analysts who are placing their bets on an interest rate hike this week.

"[The Fed] needs to preserve their credibility [after] sending mixed signals for a quite a while," John Carey, executive vice president and portfolio manager at Pioneer Investments, told CNBC last Friday.

"Having said that, I don't think they will raise by very much because there isn't a case for significantly higher rates but they need to send a signal to the market that they are ready to respond should the need for higher rates becomes more apparent," said Carey, who expects the U.S. central bank to announce a 25-basis-point hike.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.