- Home

- >

- Stocks Daily Forecasts

- >

- Where is the profit after Trump Trade War?

Where is the profit after Trump Trade War?

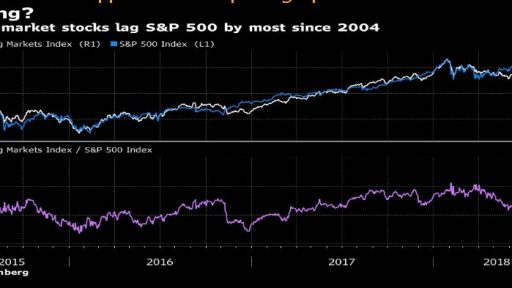

At present, stocks in emerging markets are much weaker than the US since 2004. which makes the Asian markets quite attractive against the backdrop of the improving US-China trade relationship.

What does Morgan Stanley advise at this moment?

From M.S. recommend buying shares from low beta countries, such as Peru and Chile, which, according to the bank, will significantly outperform other emerging economies. In support of their recommendation from the bank, they say that no Latin American country is Turkey's trading partner and that makes them less dependent on the crisis in our southern neighbor.

Let's look at two of the most traded ETFs in developing economies.

FXI.US W1 - Introduces Chinese large cap companies

The ETF is at a key level of support, but is already outside the upward channel formed by the collapse of Asian markets in 2015. If we are considering investing in Chinese markets through this ETF, it is good to monitor its behavior by the end of the month when the new round of negotiations between China and the US is expected. If the support zone formed by 50% Fibonacci correction and 200SMA endure and at the same time the two strongest economies shrink their hands is good to comply with it. Under such circumstances, the SL at 39.00 will be perfectly suited and could protect us from any Stop Hunting. RSI remains close to an over-sales zone, but does not report a promotion.

EEM.US W1 - MSCI Emerging Market ETF - Represents emerging markets as a whole

In the long run, the activated triangle and subsequent correction and test give us good levels for positioning with long positions. Entry from the current levels would be risky, so it's good to wait a little deeper adjustment to the area around $ 40.50. With a good development of the negotiations at the end of the month, I expect the price to be in line with the support created by the top diagonal of the triangle, 50% Fibonacci Core Trend Correction as well as 200SMA. SL would be worth $ 38.00. 50 and 200SMA remain beached while RSI is in neutral territory.

Source: Bloomberg Finance L.P.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.