- Home

- >

- Fundamental Analysis

- >

- Which are the next weak links in the EM complex?

Which are the next weak links in the EM complex?

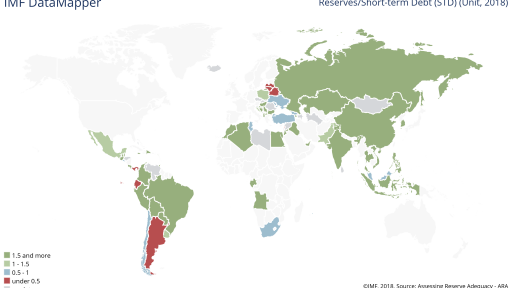

After the currency crises in Argentina and Turkey it is time to look for the next countries, characterized by large levels of debt and an economic boom financed by low-interest loans (often in dollars). One way to do this would be to use the reserve coverage ratio of the IMF, which is the ratio between the currency reserves of a country and its short-term debt.

A value below 1 is a sign of vulnerability in the economy, because the given country may be unable to cover its debt expense. Turkey, for example, has a ratio of 0.52. Argentina has a ratio of 0.42.

Looking through the countries with high levels of external debt, there are a few that we believe are especially vulnerable to a currency or debt crisis. We have not chosen the countries with the lowest ratios, but rather large economies with financial markets and a low ratio.

With red the map of the IMF shows the most vulnerable countries, while with blue and light green they mark the slightly vulnerable ones.

In Europe, apart from Turkey, there is vulnerability in the Baltic countries, Belarus and Ukraine, as well as Poland (ratio = 1). Another country with a low reserve coverage ratio and poor public finances is South Africa. The risks to the economy and the ZAR we described in a post last week: USD/ZAR: the risk of Zimbabwefication.

Of course, one ratio means nothing. What we are tracking, rather, are technical signs and signals of a weakness in the currency. As we saw with Turkey and Argentina, an initial weakness in the currency combined with financial vulnerabilities creates currency crises. For the trader, this represents opportunities.

Technical picture: USD/PLN

Entry: 3.68, after the correction is completed; in this way we minimize downside risk, while gaining exposure to the overall upwards trend.

S/L: 3.638

Source: IMF

Chart: IMF DataMapper

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.