- Home

- >

- Fundamental Analysis

- >

- Who is likely to make the headlines in 2018

Who is likely to make the headlines in 2018

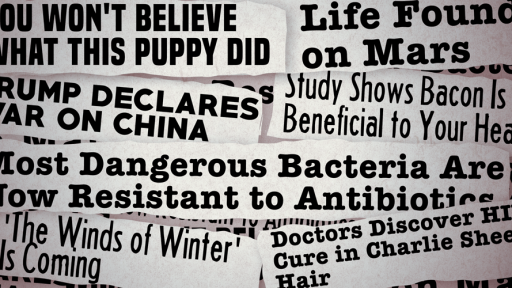

After a year of political disruption and groups raising awareness on key issues, a number of recognised and fresh faces are expected to make headlines in 2018.

Jerome Powell

In November, the U.S. administration nominated Federal Reserve Governor Jerome Powell as the next central banker to take on the role of Fed chair.

Inheriting this title in February from first female Chair Janet Yellen, Powell will be scrutinized closely by markets to see if he follows suit on the central bank's current route towards hitting its inflation target of 2 percent, raising rates and unwinding the Fed's balance sheet.

Emmerson Mnangagwa

When Robert Mugabe resigned as president of Zimbabwe in November, former Vice-President Emmerson Mnangagwa was sworn in as incumbent.

After the African nation dealt with around four decades of Mugabe's rule, Mnangagwa told the public that Zimbabwe was entering a new stage of democracy.

With the new leader promising to boost the economy by tackling unemployment and poverty, people worldwide will be paying close attention to Mnangagwa's actions in 2018, to see how he leads the country ahead of the country's elections, expected to happen before or during the fall.

The same goes for Cyril Ramaphosa, who's been elected as the leader of South Africa's ruling ANC party — previously lead by embattled President Jacob Zuma.

Bitcoin investors

Interest in cryptocurrencies has increased dramatically over 2017, with bitcoin futures already having been listed on the Cboe Futures Exchange and the CME. In fact, in January 2017, Bitcoin hovered around $1,000, yet by year-end it had risen more than $18,500, before paring.

Where major cryptocurrencies will be headed in 2018 will be of key importance to investors and economic advisors: Will leading nations step up on regulation? What industries will become more invested in blockchain technology? Watch this space.

Other market-moving assets to watch out for:

-Dow Jones industrial average (Will the rally continue?)

-Oil prices (U.S. vs. OPEC)

US administration

While the Donald Trump administration has been praised for some of its actions during its first year, like a proposed tax overhaul and tackling extremism; it has also faced a number of criticisms, including the incumbent's use of Twitter and withdrawing the U.S. out of the Paris Climate Agreement.

Whether the administration will continue on its current path, or address certain areas in 2018 is yet to be determined.

However, it's unlikely that the administration will disappear from the headlines as midterm elections, legal issues, and the country's relationship with North Korea and Russia, are set to be of key importance.

Theresa May vs. the EU

March 29, 2019 provisionally marks the moment when that U.K. is set to leave the European Union, so what happens during 2018 will be crucial in terms of divorce proceedings.

While 2017 ended with EU leaders giving the green light to move Brexit talks forward, both sides faced impasses in order to reach a compromise.

In fact, even U.K. politics went through a volatile election period after Theresa May called a snap election.

However what will 2018 mean for the U.K. leader and will negotiators from each side agree on future challenging topics like trade?

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.