- Home

- >

- Daily Accents

- >

- Who wins when world currencies depreciate?

Who wins when world currencies depreciate?

Currencies depreciated worldwide.

The Brazilian real has lost 28 percent against the dollar this year alone. Turkish lira 20%, 23% Colombian peso and Indonesian rupiah is down 11% against the dollar in 2015.

At first glance, these are alarming moves. Still, the lower rate of the currency is something that some countries actually want.

For example, China devalued the yuan by 2 percent last month, its biggest move in two decades. Experts believe that the main motivation is to make the country's exports more attractive to international buyers.

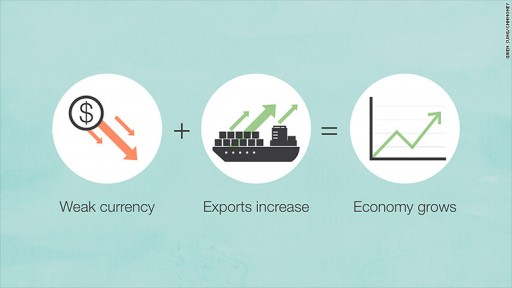

Of course, the weaker currency helps exports, which eventually can lift the economy.

"I would not be surprised if we say that two years of weakening currencies has led to better performance of the global economy," said Neil Shearing, senior emerging markets economist at Capital Economics.

However, in the short term reflux currency is a reflection of weakness in the country

In fact, the dramatic declines in foreign exchange are the cause of the Asian financial crisis of 1997, which was triggered by the devaluation of the Thai baht, which fell by 20% in one day. This crisis reverberated in the world by sending international stock markets to record lows and shaken investor confidence in the region for more than a decade.

What lies behind the recent currency declines?

The last period of the decline of the currencies is directly related to the dramatic declines in commodity prices

Many countries such as Brazil are too dependent on exports of commodities such as iron, copper, soybeans and oil. And almost all of these products fell to six-year low this year, resulting from the reduction in global demand, especially from China.

Delay of China put the brakes on insatiable demand for natural resources.

Currencies fell in value with the decline in commodity prices.

If carefully managed, these weak currencies to their countries could have a profit.

A weak currency could potentially trigger more economic growth in two ways:

1. weak currency makes exports cheaper and more attractive to foreign buyers.

2. This makes imports more expensive and less attractive for citizens, who will then be more likely to buy domestic products.

These two actions stimulate trade, domestic demand and help fuel economic growth.

Brazil, for example, recently fallen into recession. Currency and decreased by 28% this year. But in the second quarter, exports to Brazil rose by 7%, according to Capital Economics.

This will not offset all the negative factors but it is a "ray of hope" for the economic future of Brazil said Shearing.

But beware of the trade war

The expert from Wall Street Mohammed El-Erian, chief economic adviser to Allianz, describes the devaluation of the Chinese currency as an attempt to "steal" an economic growth of other countries.

It is certainly worrying for countries that compete with China for export.

Vietnam has devalued its currency for the third time this year after the course of China.

What should worry us is if these currencies fall too low.

This is when it starts to affect ordinary citizens, particularly in countries that rely on imports for everyday goods. Prices for everything are evaluated dollar go up

Venezuela is a prime example of how bad might happen.

One US dollar equals 82 Bolivar a year ago and is now worth 698 Bolivar per dollar, according dolartoday.com, a website that monitors the unofficial rate.

Venezuela's economy is in shambles and basic goods such as napkins difficult to introduce. Earlier this year, officials from the Trinidad and Tobago argued that oil is offered against napkins Venezuela

Sugar, milk and flour is not easy to buy from anyone. This is a problem when 70% of consumer goods are imported, according to the Brookings Institution.

Weak currencies also make it very difficult for countries and companies to pay their debts denominated in US dollars. Dollar-denominated debt becomes more expensive and truden to pay

Expensive debt erodes profits and economic growth.

Jr Trader E.Dimitrov

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.