- Home

- >

- Stocks Daily Forecasts

- >

- Why Alamos Gold Is a Better Choice than Agnico Eagle Now

Why Alamos Gold Is a Better Choice than Agnico Eagle Now

Gold enjoyed a solid run during the first half of 2016 with prices surging as much 25%, spurred by Brexit-induced market volatility, the U.S. Federal Reserve’s dovish stance and concerns over the global economy.

However, the yellow metal lost its momentum toward the year-end with prices retreating in the last two months of 2016 following President Trump’s election win and the U.S. Federal Reserve’s interest rate hike. Gold’s decline was also triggered by a surge in the U.S. dollar. Nevertheless, Gold regained some lost ground earlier this year with prices breaking above the $1,200 an ounce threshold.

The Fed, on March 15, raised interest rates for the second time in three months, citing an improving labor market and greater consumer confidence. The central bank hiked benchmark interest rate to a range of 0.75% to 1%. However, the Fed signaled at only two more rate hikes by the end of 2017.

In this write up, we run a comparative analysis on two gold mining stocks – Alamos Gold Inc. AGI and Agnico Eagle Mines Ltd. AEM – to figure out why the former is a better option for investment right now.

Alamos Gold, sporting a Zacks Rank #2 (Buy), engages in the acquisition, exploration, development, and extraction of gold deposits in North America. Agnico Eagle, a Zacks Rank #5 (Strong Sell) stock, engages in the exploration, development, and production of mineral properties in Canada, Finland, and Mexico.

Alamos Gold expects its gold production to be in the range of 400,000 to 430,000 ounces in 2017, a 6% rise from 2016 production of 392,000 ounces based on the mid-point of the forecast range. The company envisions its all-in sustaining costs (AISC) – the most important gold-mining cost metric – to fall 7% to $940 per ounce in 2017 from $1,010 per ounce in 2016.

Agnico Eagle, on the other hand, expects its payable gold production to decline to 1.55 million ounces in 2017 from 1.66 million ounces in 2016. Moreover, it expects AISC to rise to $850-$900 per ounce in 2017 from $824 per ounce in 2016.

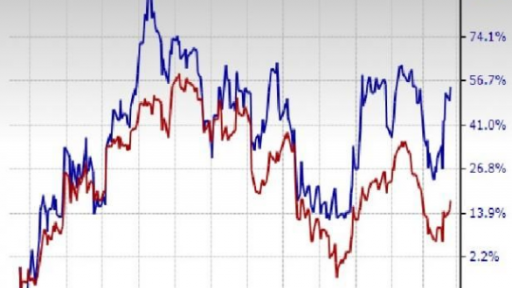

Alamos Gold has clearly outperformed Agnico Eagle over the past one year. During this period, Alamos Gold’s shares rallied 54.7% while Agnico Eagle saw a 17.5% gain. Alamos Gold has also gained roughly 22% year-to-date compared with a 5% gain recorded by Agnico Eagle.

In terms of earnings growth expectations, Alamos Gold scores way above Agnico Eagle. The expected earnings per share growth rate for Alamos Gold for the current year currently stands at a staggering 390% compared with an expected decline of 17.01% for Agnico Eagle.

Source Yahoo Finance

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.