- Home

- >

- Fundamental Analysis

- >

- Why bulls on Wall Street are becoming an endangered species

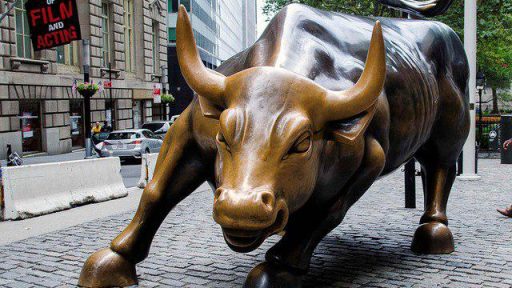

Why bulls on Wall Street are becoming an endangered species

When Krishna Memani, Chief Investment Officer at OppenheimerFunds, appeared on television several months ago to say that bulls on the American stock market had at least another five years in it, the hosts and guests were visibly stunned.

"Perhaps by the end of the year there will be a recession and I look like an idiot," he says. But this is the right call, as last year's market distortions forced the US Federal Reserve to cut its interest rate hike plans.

"The year 2018 will remain in history as the best thing that has ever happened with the economy," says Memani. "This may be a 20-year cycle until the FED has done something stupid," he added.

The shares enjoy a dramatic V-shape recovery after the chaos of December, thus being the most successful start in one year for almost three decades. But skepticism is a brilliant example of how big bulls are now almost threatened on Wall Street.

The stock market has traditionally attracted optimists, considering that the rosy outlook can attract investor inflows and increase the pot of that pays Wall Street’s salaries and bonuses. For the most part, bears have been neglected because people have not taken them seriously.

But the usual perma-bullishness has been replaced with gloom, as many analysts, strategists and economists fear that the expansion in the US economy — which in July will become the longest postwar run on record — will probably end soon.

Fund manager views on how the global economy will develop over the coming year are near their gloomiest levels since 2008, according to Bank of America’s latest investor survey. As a result, fund managers have trimmed their exposure to US stocks to the lowest point in nine months and now have their greatest allocation to cash since the depths of the financial crisis in January 2009, the survey indicates. Over a third think that the S&P 500 has already seen its peak.

However, a thin herd of bulls believes these predictions are wrong. They feel that there is a sense of "career risk" - it is safer to be with the mainstream, even if you are mistaken than to make an out-of-consensual decision that can fail.

Practically, this is pretty sharp for the bulls, as it is perceived that it is better to bearish and be wrong than bullies and wrong.

Source: Financial Times

Trader Milko Zashev

Trader Milko Zashev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.