- Home

- >

- Fundamental Analysis

- >

- Why did Mark Carney sank GBP?

Why did Mark Carney sank GBP?

The market had already priced in the interest rate rise in May. GBP/USD around 1.43-1.435 is fair given that BoE planned to raise interest rates once again this year. What went wrong and why the president of the central British bank dragged the pound down?

The most important factor to consider is Brexit. Not only is it not known what the impact on the UK economy will be, even with Soft Brexit, but also because the brexit bill has to be paid. For now, the Brexit Bill agreement is worth between £ 36-39 billion. The interesting moment comes that if the pound continues to rise against EUR, the value of these 36-39 billion will be higher than the UK desires. 36 billion pounds at current EUR/GBP levels are about 41.5 billion euros. Prior to Carney's statement, this was about 44.8 billion euros. There is a difference of € 3 billion in semi-cash.

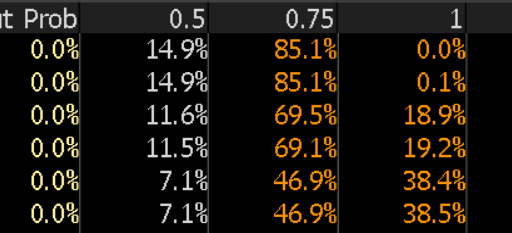

The market still expects an interest rate rise in May, even valuing the odds at 85%. But after Carney .. for another interest rate increase until the end of the year can not be talked .. at least for now.

Another important point is that once Brexit Bill is paid, 36 billion pounds will be taken out of the economy. Such a large amount of money will most likely affect the strength of the currency. Let's say that in order for the EU bill to be paid, 50% of the money will be withdrawn from the total money in circulation on the island. Taking such a large amount will create an extremely high volatility. When the cash reserves of the bank decreases and the money in circulation decreases, the value of the currency rises because there is simply less of it. Of course, the bank will probably take care of filling this hole of missing funds, but we still have to assume that if the pound is strong when paying the bill, it will probably become even stronger after the withdrawal the money for the bill.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.