- Home

- >

- Stocks Daily Forecasts

- >

- Why Goldman sees only 90 good days for U.S. stocks in 2017

Why Goldman sees only 90 good days for U.S. stocks in 2017

U.S. stocks have had an incredible run over the last two months and even at these record-breaking levels there are still profits to make — at least until March, when it will be time to run for the hills.

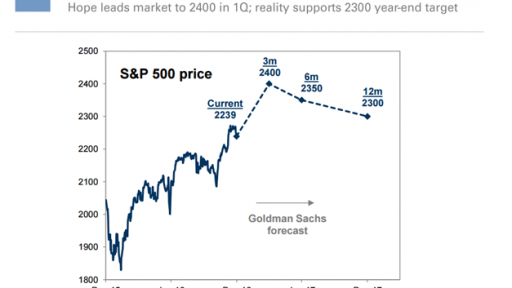

That’s a key message from Goldman Sachs chief U.S. equity strategist David Kostin, who says optimism over expected tax reforms from the Trump administration is likely to push the S&P 500 index SPX, +0.18% to 2,400 by the end of the first quarter. That implies a 6% upside from current levels and a 12% jump from just before Donald Trump won the presidential election in November.

“How to make money investing in a market that is generally highly valued? The path of the market suggests you need to make money in the first 90 days of this year,” Kostin said at a conference in London on Monday. “The key driver is the idea that there’ll be these corporate tax reforms.”

But investors are too optimistic when it comes to how low Trump can actually cut taxes and that will scupper the rally from the second quarter, Kostin warned.

“My expectation is that investors are giving more credence to the idea of tax reform than perhaps what is ultimately going to take place,” Kostin added.

“The debate over the federal deficit is going to kick off in March and there’ll be recognition that if all these proposals were to go through, there would be a significant increase in the size of the deficit. It’s not clear that could go through Congress,” he said.

Trump has proposed to cut corporate taxes to around 15% from the current 35%. While that is seen as boosting company earnings, the federal deficit could balloon by 60% and reach $1 trillion in 2017, according to Goldman. The deficit stood around $600 billion in 2016.

“The deficit creates some limitations on how much of that can implemented. So maybe at the end of the day, the earnings revisions are not as significant as some of the investors now think,” Kostin said.

After peaking at 2,400 in March, Goldman expects the S&P to end 2017 around 2,300.

Kostin stressed, however, that he does expect Trump to succeed with some tax reforms, which should benefit companies that pay the highest effective tax rates. In a December research note, Goldman mentioned CarMax Inc. KMX, +0.54% , Monster Beverage Corp. MNST, +3.25% , Hess Corp. HES, +0.07% and Charles Schwab Corp. SCHW, +0.36% as companies that are likely to benefit.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.