- Home

- >

- Great Traders

- >

- Why technical analysts are celebrating this Bill Gross tweet

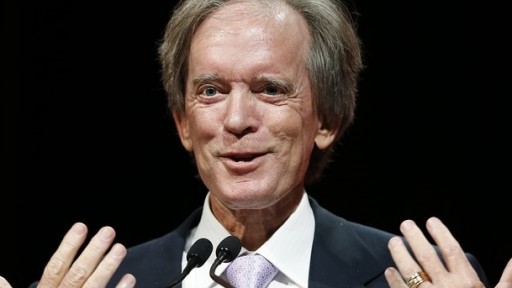

Why technical analysts are celebrating this Bill Gross tweet

Technical analysis can be a tough business.

By MarketWatch, Cable business-news shows and financial journalists pay them relatively short shrift, even though there seem to be few great traders or money managers of any bent that ignore the charts altogether.

But naysayers are often quick to put down technical analysis, glibly dismissing it as after-the-fact rationalization or worse.

So it was no surprise chart watchers were virtually high-fiving each other after bond guru Bill Gross on Wednesday took to Twitter to reference a well-known chart pattern:

@JanusCapital - Gross: “Reverse head & shoulders (yields) in all global bond markets. Necklines being broken by the hour. Bearish.” - 4:11 PM - 9 Jun 2015.

The tweet seems to follow up on Gross’s prescient April call to short German bunds BUNL, +0.04% , betting yields will rise (though it’s not clear the former Pimco chief and current Janus Capital fund manager followed his own advice).

As for the reverse head-and-shoulders pattern, Gross, unfortunately, didn’t include a chart to illustrate, so here’s one from Adam Button at forexlive:

Button captured the mood of the chart-watcher community:

“The head-and-shoulders pattern is one of the most well-known signs of a top or a bottom in a market. That someone as revered as Bill Gross uses it, is incredible.” Button continues: “It’s not a textbook example, but if it’s good enough for a billionaire bond trader, it’s good enough for me.”

Over at ValueWalk, Mark Melin said Gross’s tweet revealed that he’s using “trading techniques from ‘old school’ discretionary traders. Evaluating a chart pattern and reading into it a head-and-shoulders top pattern is a discretionary black art practiced by the old Jedi masters.” The“Jedi” comparison might seem a bit over the top. After all, at least as far as chart patterns go, the head-and-shoulders pattern seems to be fairly well known.

But Melin notes that while the chart pattern can be monitored with computers these days, they often aren’t part of the algorithmic pattern analysis they use to hunt for market reversals. That’s in part because the pattern is a “late” mean-reversion signal, he wrote. Studies, however, have shown that their benefit isn’t in determining the start of a trend reversal, but instead in “giving validity” to the continuation of a trend.

“In other words, Bill Gross is showing his old-school trading techniques, which he no doubt combined with rather astute fundamental skills,” he wrote.

As Michael Batnick at the Irrelevant Investor blog lays it out: “Some people rely solely on technical analysis, while others incorporate it into their overall analysis.”And then, getting to what really confounds the technicians, Batnick notes that even “nonbelievers” often “use some form of technical analysis without even recognizing it.”As Batnick points out, if you’re someone who’s ever said a market is overbought or oversold or breaking out or trending higher, then you too are using technical analysis.

Good stuff, but not everyone is convinced. Cullen Roche thinks articles like this violate the “Crayola Crayons Rule,” one of his 11 “operating guidelines for financial journalism.” He argues that drawing lines on charts isn’t financial analysis and that “‘head and shoulders’ is a type of shampoo, not a useful market indicator.”

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.