- Home

- >

- FX Daily Forecasts

- >

- Why the dollar will turn from a winner to a loser by the end of the year

Why the dollar will turn from a winner to a loser by the end of the year

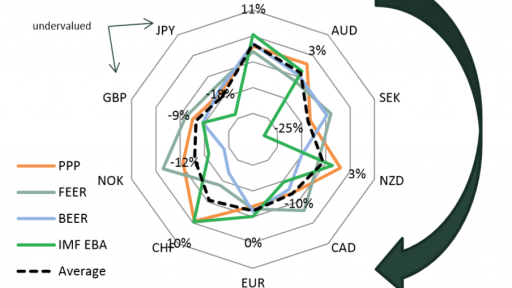

The US dollar is the second best performing currency in G10 this year, only behind the Swiss Frank. But analysts at TD Securities are of the opinion that the best is already in the rear mirror.

They cite several reasons:

1) Economic surprises begin to decrease. The US economy is strong, but "many of these good news are already reflected in the price of the currency, and new catalysts will be needed to inspire a significant rise in dollars from now on."

2) Fed. Analysts say central bankers are close to neutral and other banks are starting to become more aggressive / hawkish /

3) Global growth has gained momentum and this will be the focus on end-of-year markets

4) There are too many traders invested in the dollar, so its value is artificially exaggerated

5) Financing of the external deficit will become a problem and the history of the double deficit returns with revenge and this will be a story for 2019 as the Anti-Corruption Board and the ECB allow this.

6) Political uncertainty undermines confidence in the dollar and trade risks unexpected consequences

Personally, I welcome the view of change to global growth, which in turn will put raw materials under pressure.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.