- Home

- >

- FX Daily Forecasts

- >

- Why the US dollar is so strong today

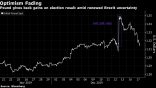

Why the US dollar is so strong today

Stocks aren't doing much and the bond market is flat. If it was a fundamental story, you would expect to see some kind of reaction outside the currency.

Powell is speaking at Jackson Hole early on Saturday, that could set up a move in markets after the weekend but could this be front-running on hopes for something hawkish? That's tough to believe with other, smaller markets not reacting.

So flows? That's a bit of a cop-out but there's no great reason for so much USD buying today. The market is already heavily net-long dollars so specs probably aren't a big factor, but that can't be ruled out because it's a less-liquid time.

Elsewhere, there are reasons to sell other currencies. The Australian dollar is getting hit by political trouble and a potential spat with China over 5G technology. Cable is always vulnerable to Brexit headlines, although there isn't anything damaging today.

Emerging market currencies are a good bet to be part of the problem. The South African rand is down 1% on Trump's tweet with every other EM currency also lower with the exception of Argentina's peso.

So on net, it's still a mystery. That could mean China is at work or some other central bank is buying dollars and that's what I guess is underway. The thing is, that's not going to be sustainable so I'm not sure this round of dollar buying will last.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.