- Home

- >

- Daily Accents

- >

- Why Trump does not like the strong dollar? History gives us the answer

Why Trump does not like the strong dollar? History gives us the answer

President Donald Trump chose a rather inappropriate moment to blame the Federal Reserve for allowing the US dollar to become so strong. After all, the dollar remained below its highest levels since last December, and the FED changed its position.

Trump does not seem to be heard from the markets that have changed, assuming that interest will be paused by the end of this year, with Federal Funds Futures pointing out only a slight increase in interest rate cuts in January 2020. Trump, however, your word that the dollar is strong, and that it will be better for the US economy if it weakens.

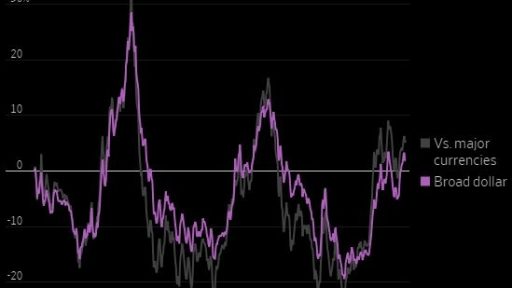

To a certain extent, he is right. "Green money" is really strong, but not so much. The dollar is about 5 percent above its wider rivals since it has moved freely since 1973, after equating itself to inflation, and is about 10 percent better off than the currencies of the developed countries since then. It does not even come close to its peaks in 1985 and 2002, and so is the value of the dollar against the euro, where USD stands at 4% above its average performance since the single currency was introduced in 1999.

The strength of the US dollar reflects something Trump is proud of: the US economy performs much better than most countries in the rest of the world. The dollar should be relatively strong, because the US economy performs well compared to other developed countries and inflation is almost at a target. The central banks of the Eurozone and Japan are still in "critical condition", with the maintenance of negative interest rates and unstable growth. At the same time, China is trying to boost its economy after a sharp slowdown.

Trump is a mercenary personality. He sees the weak currency as an opportunity to attract businesses from other countries. From this point of view, the weak dollar will be ideal for making good exports.

However, this is wrong in the long run. The best-performing currencies since the 1900s are the Swiss franc and the Danish guilder (now part of the euro) and the US dollar. However, the Swedes and Danes are heavily dependent on exports, and those who have depreciated - their competitiveness has become a victim of inflation. However, we can assume that the strong currency encourages companies and workers to raise their turnover. This effort will pay off with time, making the state even more competitive.

If we go back to the short-term option, however, weak currency supports exports at the expense of imports. As long as necessary. However, if we assume that the US has high consumption but few jobs, the weak currency will be exactly what we need.

But the effect is unlikely to last long. The story of the depreciation is that it makes sense where inflation is eroded because companies and workers do not have the same effort to improve their competitiveness as countries with strong currency.

The weakening of "green money" after a federal move would mean reducing interest rates below those that the FED now considers normal. With inflation within the framework, wage rises, the growth of the economy and the fall in unemployment, we would hardly believe that the FED will continue with monetary stimuli.

Perhaps this time the FED is wrong and Trump is right. And the economy has the potential to grow faster without catalysts to raise prices and wages, and it creates instability.

But that's why the United States has an independent Central Bank, because politicians are constantly demanding low interest rates and short-term incentives. Now is the time different?

Source: The Wall Street Journal

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.