- Home

- >

- Commodities Daily Forecasts

- >

- Wilbur Ross predicts $35-$40 oil, no freeze at June OPEC meeting

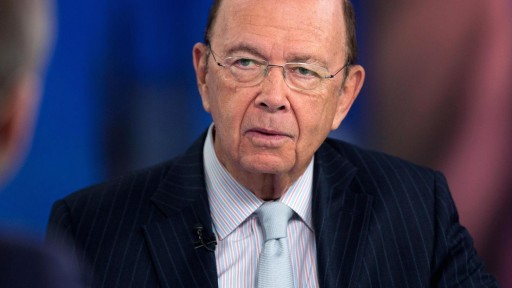

Wilbur Ross predicts $35-$40 oil, no freeze at June OPEC meeting

Billionaire investor Wilbur Ross is among the players predicting oil will languish in the mid-$30s after the Doha summit ended without a deal.

Ross, chairman and CEO of private equity firm WL Ross & Co, told CNBC's "Asia Squawk Box" on Monday that prices would range between $35 and the low $40s in the near future.

A summit in Doha between the world's largest oil-producing countries ended without an agreement on Sunday, as leaders failed to broker an agreement to freeze output in order to boost sagging crude prices.

The conference's failure sent U.S. crude and global benchmark Brent fall as much as 5 percent each to around $38 and $41 a barrel, respectively.

Prices were unlikely to return to the $20 level, Ross said, but added that they wouldn't rise significantly above $40 either given the market's persistent problem of high inventories.

Those hoping for an agreement by OPEC's (Organization of the Petroleum Exporting Countries) next meeting in June will be sorely disappointed, he continued, warning that no deal was likely until Iran returned its production to a pre-sanctions level.

"It's been my belief for some time that Iran wouldn't agree to any limits on their production until they're back up to four million barrels a day...In the meantime, I don't see Saudi Arabia cutting their production while Iran keeps building theirs," Ross said. "These talks were doomed for failure."

The June meeting could possibly produce a structural framework for a potential deal on freezing output, he noted.

"But even if you reach a deal on production, the next challenge is enforcement," Ross said.

"Part of the reason we got to where we did with the Saudi's announcing they weren't going to play any more is because in prior agreements, the only ones who abided by them were the Saudis and they apparently have gotten tired of cutting their production just so other parties can keep theirs up."

Victor Shum, vice president of IHS Energy Insight, echoed those sentiments.

"I wouldn't be surprised if Brent drops to the mid-$30s today or within next few days," he said.: CNBC

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.