- Home

- >

- Daily Accents

- >

- Will the Fed reach the 2% inflation soon?

Will the Fed reach the 2% inflation soon?

A very smart analyst joked yesterday that the Consumer Price Index is the new Nonfarm Payroll. Since the FOMC has made it clear that they are waiting for 2% inflation—or perhaps Godot—all eyes are searching for signs we might be getting there, so all price indexes are good fodder, especially the PCE, the Fed’s favored index.

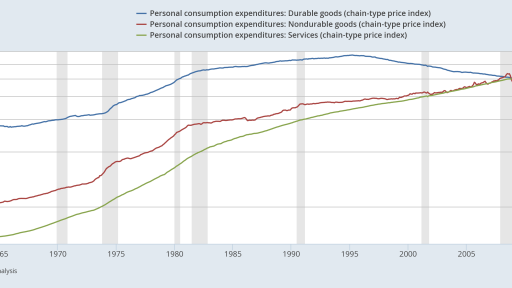

The FOMC’s models have continually demonstrated a “just around the corner,” feature where, despite currently weak PCE measures, the expectation is that higher inflation would occur in the near future. Unfortunately, a historical look at the broad components of this inflation measure belies their optimistic projections:

Above is a logarithmic graph of the three components of the PCE price index: durable goods prices (in blue), non-durable goods prices (in red) and service prices (in green). Two key visual elements are apparent: durable goods prices have been consistently declining since the mid-1990s. Non-durable goods prices have been stagnant to slightly lower for the last 5 years. That leaves services as the only PCE price index component that can exert upward pressure.

Let’s look at the same data from a Y/Y percentage change perspective:

Durable goods prices (in blue) have been subtracting from price growth for the last 20 years. Non-durable goods prices (in read) have been declining since 2011-2012; they subtracted from PCE price growth for most of 2015 and only recently turned positive. Only service prices (in green) have increased PCE price pressures on a consistent basis.

There are several important lessons to draw from this data. First, the PCE price index looks at prices from a business perspective. According to the Cleveland Fed, “the PCE is based on surveys of what businesses are selling.” The above charts indicate that neither durable goods nor non-durable goods companies have any pricing power.

Second, the Y/Y percentage change in service prices has been declining. Third, price growth for 31% of PCEs are either negative or very weak. That means the remaining 70% of prices would have to increase at a faster Y/Y rate to hit the Fed’s 2% PCE Y/Y inflation target. This runs counter to the second conclusion regarding service prices, that the y/y rate of change is narrowing.

Those trends mean the Fed cannot hit its 2% y/y target under the current circumstances.

Source: Bloomberg Pro Terminal

Trader I. Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.