- Home

- >

- Daily Accents

- >

- Wall Street threw the laics out of the dock

Wall Street threw the laics out of the dock

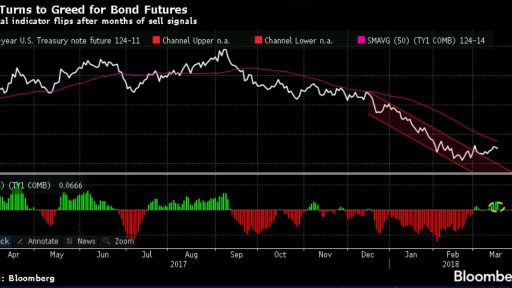

Rising bond prices over the last days have formed a good rebound from the bottom, which is considered the gateway to the next adjustment. Bonds are also supported by Bloomberg's Fear and Greed Indicator (FG5), which is an indicator of inertia and market attitude. The Fear/Greed indicator reached levels from 5 months ago and signaled a reversal in the price of bonds, but that's not important. The question for a large number of traders is will Wall Street turn down the small players on the market, claiming the collapse is inevitable?

How could this happen?

In a few words, as with EUR/USD. When we have a trend, we tend to look for input, backed up by fundamental news and technical levels, and often overlook the likelihood that it will change. As you might guess, just a year ago, the EUR/USD situation was the same as for bonds. There was no media that did not argue that EUR/USD would hit the parity and that it would even drop below 1.0000. Wall Street's big names, such as Goldman Sachs, Morgan Stanley, BNP Paribas, also backed the thesis, and they were very convincing about the fundamental facts about it. But everything about EUR/USD is in the past, let's look at the markets today.

The main characters today are not the "weak economy" in the EU and the Fed, but the value of bonds and stock markets. Just as during the EUR/USD decline, a large part of the economists and investment banks mentioned above argue that a bond yield growth of more than 3% will lead to such a market failure that we can not imagine. If we add protectionism from the US, we will undoubtedly think that things are really bad. Is it true? Currently, the answer is No, because Trump's tariffs will not affect the global economy as much as any media and big names say. The key to getting the markets collapsing and bond yields rising above 3 percent is Trump to impose tariffs on Chinese goods produced by theft of intellectual property. You can guess that it would affect almost every Chinese product by starting from the nightstand's alarm clock, going through the smartphone in your pocket and reaching the car waiting for you in the garage. Let's not be fooled, Trump is a pure-blooded businessman, and he would hardly take such a measure.

Yes, surely, there is no factor on the horizon to bull the way President Trump chooses, but there is also the specific reason that will cause consumers to spend less, and this will lead to a recession.

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.