- Home

- >

- Daily Accents

- >

- Big ones to win and to lose if Le Pen scores the French elections

Big ones to win and to lose if Le Pen scores the French elections

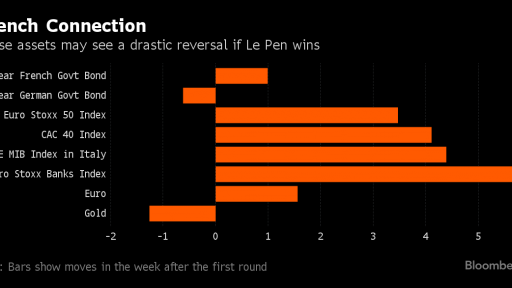

After a relief rally fueled by polls projecting an easy victory for French presidential candidate Emmanuel Macron, a win for his anti-euro rival Marine Le Pen would likely rock equity markets that are already pricing out risks to the region’s stability.

With the poll margin wider than for the Brexit referendum and the U.S. election, such an improbable win for Le Pen could lead to losers and bigger losers in the immediate aftermath, analysts and money managers warn. Markets would also see a resurgence in volatility.

The difficulty with the victory of Le Pen is that the political risk would increase quite dramatically so all the high-beta sectors will suffer.

Here's more about who will be the winners and losers if Le Pen wins the Sunday election.

WINNERS:

- Defense - Le Pen advocates raising France’s defense spending to 3 percent of gross domestic product by 2022 -- compared with Macron’s proposal for 2 percent -- and enlarging police and security forces. Higher expenditure would boost the sector, and a weaker euro could aid commercial aerospace stocks, according to Citigroup Inc.

- Nuclear -Le Pen proposes a multi-billion euro plan to re-fit France’s nuclear plants -- a stark contrast with plans by both Macron and the current administration to reduce reliance. Still, any benefit for Electricite de France SA -- the state-controlled utility that monopolizes nuclear production in the nation -- would be offset by her plans to pull EDF out of the U.K.’s Hinkley Point nuclear project and potentially re-nationalize the firm, said Bloomberg Intelligence analysts Rob Barnett and Elchin Mammadov.

- Global giants -Just as the post-Brexit plunge in the pound boosted the revenue of U.K.-listed global megacaps, a drop in the euro spurred by Le Pen’s win could be a boon to French counterparts. The CAC 40’s biggest names including LVMH Moet Hennessy Louis Vuitton SE, L’Oreal SA, Sanofi and Airbus SE have little exposure to the country’s economy. Its members on average get only about a quarter of their sales from France, data compiled by Bloomberg show.

LOSERS:

- Banks -A Le Pen win could devastate regional banks, among the biggest gainers after the first round. A plunge in bond yields amid a scramble for haven assets would depress expectations for bank earnings. Her opposition to the euro would spark fears that in a worst-case scenario, France could pull out of the single currency, triggering its collapse and forcing banks to re-denominate their assets.

- Concession companies -Le Pen, with her call for “economic patriotism,” has championed nationalizing airports and highway operators. This would bode ill for concession firms such as Vinci SA, Eiffage SA and Spain’s Abertis Infraestructuras SA, which owns Sanef in France, according to Societe Generale.

- Indebted Domestic firms -French firms with large domestic exposure would suffer the most from heightened economic uncertainty upon a Le Pen victory. Those that have to repay large amounts of euro debt -- such as banks, real estate firms and utilities -- would also suffer from concerns of France returning to a potentially weaker national currency, according to UBS.

We recall that the second round of elections is on Sunday, and at the opening of the markets after 00:00 is expected to increase the volatility of the cross with the euro.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.