- Home

- >

- Daily Accents

- >

- Worried investors return with renewed risk appetite

Worried investors return with renewed risk appetite

Whisper: Goldilocks may come back!

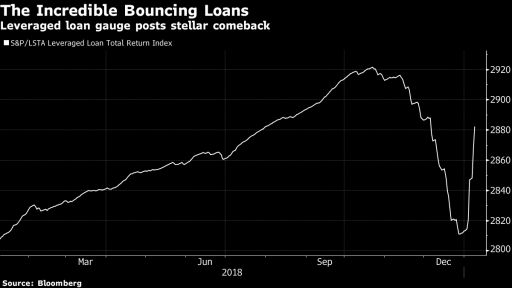

Volatility falls and the S & P500 enjoys a three-day rally for the first of last November, while debt markets also show strong backsliding. Bouncers in all asset classes that are beginning to rebut the December dips.

It seems that the "stars are stacked" for those looking to buy the bottoms. President Trump is also aware of his negative impact on his aggressive trade policy, and he has changed his attitude to China and the trade war. The Federal Reserve has already signaled a dovish tone, potentially expected to ease financial conditions as well as pressure on the US dollar. Incentives in China are another reason for joy.

But fears continue to exist considering Brexit, the slowdown in global growth, rising levels of debt, factors that threaten those who rediscover the desire for risk.

The sunset of the dollar

The strong progress of green money in 2018 has helped America once again be "the first" in the world, striking the emerging markets and raw materials. Only a few days have passed since the New Year and we already have signs of a twist. The US dollar index is cheaper at eight out of ten sessions for the moment. Wall Street is getting more and more bearish to the currency, even though investors are still long positions against the dollar.

The 200-day moving average for the US currency is only 0.6% away from the price, and now 100 daily creepers can now act as a resistance to any rebound attempt. The Chinese yuan is also back. The prospect of a positive turnaround in the trade war has strengthened the Chinese currency to its strongest levels since August.

Stock prices

In Europe, the 50-day moving average of the Stoxx 600 may be a key element on which to focus investors in the coming days. In the last sessions of 2018, the index hit a two-year low and ended in 2018 with a 13% drop, which was recorded as the worst performance of the index since the financial crisis.

How is it going for January

Peter Oppenheimer, a strategist at Goldman Sachs, believes there is a risk that investors who fail to get involved in this rally will lose the potential for big profits by the end of the year. And the debt has returned. Cash flows are returning at the fastest pace since the crisis.

Rally in commodities

Oil is on track to record its best start on an annual basis at all. Growth in oil prices is a plausible signal for shaping the next industrial cycle. WTI has risen by more than 13% in the first six trading days - more than any other comparable period that can be earned since 1983.

It seems that the demand for government securities is declining. They enjoyed great interest as a safe heaven during the stock sales. The yield on 10-year US bonds is growing rapidly. With 2.55% yield and now with 20 basis points growth, the next limit of 2.75% is ahead.

Source: Bloomberg Finance L.P.

Графики: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.